Demand for spot truckload capacity slows seasonally

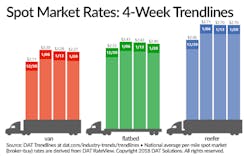

National average spot van and flatbed rates fell slightly and the refrigerated rate was unchanged during the week ending Jan. 20 despite 3.5% fewer loads and a 4.6% increase in trucks posted, according to DAT Solutions, which operates the DAT network of load boards.

The gradual decline in rates is in contrast to the sudden increases following the Dec. 18, 2017, ELD deadline. Van and reefer load-to-truck ratios edged down for a second straight week after hitting multi-year peaks in early January:

- Van load-to-truck ratio: 9.8, down from 10.7 the previous week

- Reefer ratio: 15.5, down from 18.4

- Flatbed ratio: 53.9, up from 53.7

VAN MARKET: Van load posts fell 5% and truck posts increased 4% as the national average spot van rate fell 1 cents to $2.27/mile. Rates were down on most of the top 100 van lanes but stayed elevated in key markets:

- Dallas, $2.05/mile, up 2 cents

- Philadelphia, $2.43/mile, up 11 cents

- Chicago, $3.05/mile, up 5 cents

- Memphis, $2.61/mile, up 6 cents

Los Angeles dropped 14 cents to $2.53/mile after losing 16 cents the previous week.

REEFER MARKET: The national average reefer rate was unchanged at $2.70/mile as load posts fell 10% and truck posts increased 7%. Capacity was in demand in Northeast hubs including Philadelphia ($3.46/mile, up 16 cents) and Elizabeth, N.J. ($2.35/mile, up 10 cents), where traffic has been affected by winter weather. Reefer load counts and rates fell off sharply from Nogales, Arizona, as domestic produce begins to displace imports from the U.S.-Mexico border.

FLATBED MARKET: Flatbed load posts increased 3%, truck posts were up 2.5%, and the national average flatbed rate fell 2 cents to $2.40/mile. Key regional markets are showing strength:

- Las Vegas, $2.89/mile, up 7 cents

- Phoenix, $2.24/mile, up 6 cents

- Savannah, Ga., $2.78/mile, up 5 cents

- Houston, $2.65/mile, up 8 cents

- Harrisburg, Pa., $3.76/mile, up 18 cents

- Los Angeles, $2.53/mile, down 14 cents

Flatbed rates were softer in the Midwest last week, including outbound from Rock Island, Ill. ($3.03/mile, down 16 cents), and Cleveland ($2.64/mile, down 10 cents).

The national average price of on-highway diesel fuel remained near a three-year high at $3.03/gallon. Spot truckload freight rates include a fuel surcharge portion.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. For the latest spot market load availability and rate information, visit dat.com/industry-trends/trendlines and join the conversation on Twitter with @LoadBoards.