‘Death, taxes, and distribution’: Analysts on what election means for trucking

COLUMBUS, Indiana—Who wins this fall’s Presidential and Congressional elections will impact trucking—as decisions made in Washington, D.C., often do. And gauging which major candidate will serve the industry best is a quadrennial tradition among trucking prognosticators and executives.

What’s at stake: Presidential decisions impact the economy and regulations. These two things impact how manufacturers and suppliers plan and produce for their customers: the carriers and fleets whose own planning and profits are ruled by the freight market and transportation regulations.

“Whether Donald Trump or Kamala Harris gets elected, there are going to be some changes one way or the other,” Kenny Vieth, ACT Research president, said hours before Harris accepted the Democratic nomination last Thursday. “But I do think the beauty of this industry is that the U.S. economy is entirely dependent on trucks and truck transportation. And regardless of who gets elected, we’re still going to be eating and drinking and buying clothes and cars and houses the day after the election. We are, as a group, in a very good industry. It’s like death, taxes, and distribution.”

See also: Where the candidates stand on trucking issues

Red vs. Blue (or in the red vs. black?): With the Democratic National Convention underway just 200 miles to the northeast, the election topic was on the minds of suppliers, manufacturers, carriers, brokers, and others gathered for ACT Research’s Market Vitals seminar here on August 21 and 22.

The twice-a-year seminar shares proprietary insights and forecasts from ACT’s economists, analysts, and industry guests on commercial vehicle and transportation markets.

DAT Freight & Analytics principal analyst Dean Croke, who fielded questions during the seminar, said Republican governments value trucking more. But change could be worse.

- “I’m more concerned about the Democratic side of the agenda, pushing regulations based on environmental issues—regulations that are really cost-prohibitive for carriers,” he said on the opening day of the ACT Research seminar.

- Croke added that he is concerned about both sides. He said Trump’s promise to impose more tariffs could create a trade war.

- “I think that would be very destructive to the freight market. We saw a little bit of that between ‘18-’19 … That disrupted the trade market and set us into that spiral in 2019. So I’m kind of sitting on the fence here, but I err on the side of I think if we kept the same administration, we’d be OK. If we had a new administration, I think that would be more destructive.”

- The secretary-general of the International Chamber of Shipping said recently that Trump’s tariff threats could undermine world trade and lead to more problems. “The world order has never been under such threat since before the Second World War,” Guy Platten, secretary-general of the International Chamber of Shipping, told the Financial Times.

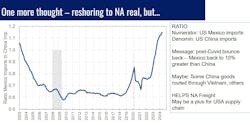

Economic outlook: Jim Meil, ACT Research principal and industry analyst, said that nearshoring is having a real impact on manufacturing and freight. Mexico’s imports are now 10% higher than China’s, surpassing 2003 market shares before China’s export boom.

- Meil cautioned: “This isn’t the whole story, but we think it’s an important story and at least part of the jigsaw puzzle that brings freight back to North America.”

- Headwinds: Meil and ACT estimate that 40% of truck freight originates from manufacturing. However, as the U.S. feeds technology sectors, semiconductor fabrication is less trucking-intense than diminishing nondurable goods such as paper and printing-related activities.

See also: Refrigerated carriers cautiously optimistic about 2025

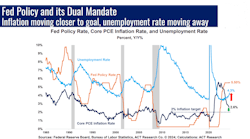

What about rate cuts? Both Meil and David Teolis, ACT Research’s chief economist, indicated they expect a rate cut by the Fed in September but probably at 25 basis points.

- Teolis expects the Fed’s first cuts to concentrate on being “less restrictive before they become more accommodating.”

- “So the idea is don’t get too excited about rate cuts in the early stages of the rate cuts.”

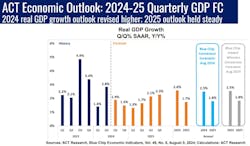

- “We will see growth pick up, but our view is that we’ll hit a soft patch for the first half of 2025, and then we’ll see an acceleration in the second half.”

- Along with the election, potential disruptions include the Middle East conflict, Fed policy moves, China trade, and more.

Waiting on the 2027 prebuy: Intense federal and local emissions regulations are pushing more alt-fuel powered trucks and expensive emissions-reducing technology on internal combustion engines that could increase heavy-duty truck costs by at least $20,000 later this decade.

- Equipment buyers, however, might be waiting for things to be more settled. Jennifer McNealy, ACT Research’s director of research analysis and publications, said trailer OEMs also wonder how the election will affect equipment orders.

- “They’re telling us their customers are cautious because of the election,” McNealy said. “They want to see what’s going to happen going into 2025 with their demand and what’s happening in freight.”

- Diane Hames, VP of commercial strategy for Navistar, said the election could impact how fleets approach a prebuy.

- Hames said the International Trucks OEM is “looking at scenarios for what ‘25-’26 are going to look like. The industry is struggling to fill the rest of the ’24 order board, particularly in the tractor segment.”

- A year ago, Hames was expecting a “strong prebuy for ’25 to ’26 based on what we saw coming with the discourse over regulations. That obviously is changing, and I think that a lot of this will be unsettled—at least partially unsettled—until we see the outcome of the election and what’s happening with the overall freight market and underlying economic fundamentals.”

Could Trump end the push for EVs and other alt fuels? Despite Trump’s promises to end electric vehicle mandates if elected, the Supreme Court’s Chevron doctrine ruling this summer did not make it easier to end the Environmental Protection Agency and the California Air Resources Board’s clean fleet regulations, such as phase three of the federal Greenhouse Gas Emissions Standards for Heavy-Duty Vehicles—known as GHG3.

- “The Supreme Court’s ruling on the Chevron doctrine recognizes the importance of Congressional delegations of discretion to agencies like EPA and in status expressly cited the Clean Air Act,” according to a Forbes article by Margo T. Oge, a former director of the EPA’s Office of Transportation and Air Quality.

- Oge argues that the EPA’s new transportation emissions standards fit within its Congressional-given role.

- Lydia Vieth, ACT Research analyst for electrification and autonomy, summed it up this way: “Obviously if Harris is elected, I think we know things will kind of continue as they are. If Trump is elected, it will be very hard to totally reverse the EPA regulations on NOx. That’s pretty stuck.”

- “The EPA has the authority, under the Clean Air Act, to regulate emissions. So it’s hard to say that is not actually in their purview to do. All that said, it doesn’t mean he wouldn’t try … But we think it will be very hard, in the courts, actually to undo GHG3 given Chevron.”

- Vieth noted that OEMs and others have invested a lot of money into decarbonizing transportation. It is unlikely that investment would be abandoned.

- Navistar CEO Mathias Carlbaum put the OEM decarbonization plans this way during a discussion with some rival OEM leaders in Washington, D.C., earlier this year: “We’re on this journey here with or without regulations.”

See also: All the FMCSA regulations and rulemakings in the works

Complexity and opportunity ahead: Trucking drives the U.S. economy (more than 70% of all U.S. freight moves by truck) and looks for business-friendly administrations and Congresses to thrive.

- “We’re hoping this economy can be stimulated by what’s to come—so seeing a tougher business environment certainly seems contractionary on the freight demand environment,” David Spencer, VP of market intelligence for Arrive Logistics, said in response to a question about the presidential election.

- “Regulations create unique challenges, but that also creates volatility. So I think from our perspective, there’s going to be challenges and opportunities no matter which administration takes hold.”

- “It’s kind of like the freight market—it’s hard to tell exactly what those opportunities and challenges are going to be with either administration,” Spencer added.

- According to Kenny Vieth, ACT president: “I think complexity is an opportunity for everybody in the room,” he said to attendees representing some of the U.S. trucking industry’s most recognizable brands.

- He said it “always defies logic” that the industry fights back when regulators want to make trucking more complex.

- “Barriers to entry in trucking are so low. If they would encourage some difficult barriers to entry—that actually makes trucking harder—it would benefit them because, just like the industry, if you can bring value, you can make more money.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.