Private fleet benchmarking survey shows equipment trends, increase in driver retirement

This year’s annual National Private Truck Council benchmarking survey revealed fleet growth in shipments, volume, and value proposition. But it also showed changing trends in equipment acquisition strategies and the source for a year-over-year increase in driver turnover.

Private fleets are changing their equipment procurement strategies and revisiting driver retention strategies as many longtime drivers enter retirement, according to the National Private Truck Council’s annual benchmarking survey. While the survey reports private fleets are experiencing growth, the average number of fleet power units has shrunk, and there has been an increase in driver turnover year over year.

Leased vs. owned equipment

Private fleet equipment and personnel stats

Equipment stats

- The average size of Class 8 tractors per fleet has decreased from 442 (2023) to 390 (2024)

- 38% own 90% or more of their trucking fleet

- 28% lease most of their fleet

- 34% operate a combination of leased and owned equipment

- 32% “turned to the rental market,” up from last year’s 29%

Personnel stats

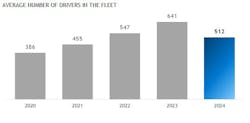

- The average private fleet employs 512 drivers compared to last year’s 641

- 83.5% exclusively and directly employ company drivers

- 91% of driver population are company drivers compared to last year’s 94%

- Driver turnover increased from 19% in 2023 to 20.2% in 2024

- The average age of drivers is 49.32

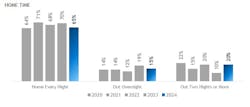

- 65% of drivers are home every night

- Average annual driver pay is $90,000

While private fleets report growth, the average size of Class 8 power units per fleet has decreased from last year’s average of 442 to 390, according to the survey. However, 38% of respondents report owning 90% or more of their trucking fleet. About 28% of respondents report leasing most of their fleet. This leaves roughly 34% of private fleets operating a combination of leased and owned equipment.

Respondents report a 5% gain in the owned portion of their fleets compared to a 1.64% gain in owned equipment from last year’s report. The number of leased equipment gained in private fleets grew 8.3% year over year, compared to 17.7% last year, according to the report.

According to the NPTC report, while fleets primarily own equipment (60% compared to 40% for this year’s report), some fleets might decide upon leasing as an acquisition strategy “when equipment shortages were more prevalent,” such as within the past few years.

“There was a period of time when it was really hard to procure equipment—that certainly impacted things,” Jim Lager, EVP of Penske Truck Leasing, said in a media briefing about the survey results. “We picked up some lease customers who hadn't previously leased because they simply couldn't purchase equipment.”

Based on an analysis of private fleet behavior for 2023, the NPTC report indicates that, even though vehicle inventory increased, 32% of respondents reported "turning to the rental market," up from last year’s 29%.

See also: America’s Service Line named FleetOwner Private Fleet of the Year

Private fleets and driver retention

The average private fleet employs 512 drivers, according to the survey, down from last year’s 641 reported drivers. Respondents consider these drivers company drivers, leased drivers, owner-operators, and temporary personnel.

Most fleets (83.5%) exclusively and directly employ company drivers, which is a similar number to last year’s report at 84.5%. Company drivers make up 91% of the driver population for private fleets, according to this year’s report, compared to last year’s 94%.

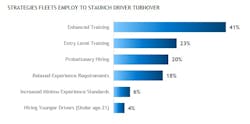

While driver turnover is typically lower for private fleets than for-hire fleets, the NPTC survey reveals driver turnover is up year over year, from 19% in 2023 to 20.2% this year.

Cassie Wood, transportation manager for paper and cardboard manufacturing company Packaging Corporation of America, and Mike Schwersenska, general manager for Brakebush Transportation Inc., cite retirement as their companies’ top reason for driver turnover.

Survey respondents report the average age of private fleet drivers is barely below 50 years old at 49.32, which is in line with last year’s report at 49.75. The increase in drivers leaving the industry for retirement coupled with the aging population of truck drivers highlights a need to recruit younger drivers and retain the ones that are already employed.

To inspire driver loyalty and improve the driver experience, Packaging Corporation of America developed a fleet strategy to ensure drivers have more time at home by employing more local and some regional routes, Wood said during the survey’s media briefing.

The report indicated this could be a trend among many private fleets, as it could increase driver satisfaction and, therefore, increase retention. Respondents indicated that 65% of their drivers are home every night, and 15% work overnight—down from last year’s 19%.

“We see a lot lower driver turnover on the private fleet [side], obviously, because of the time and attention that's given to these drivers,” Wood said. “They’re home every night, every other night ... It's a job that drivers want, so we don't see a lot of driver turnover.”

Other strategies private fleets use to increase driver retention include increasing their pay.

According to the survey, a driver’s “average W2 earnings at the end of the year were just shy of $90,000 and that's up about $5,000 from last year,” Tom Moore, executive VP of NPTC, said in the briefing. “We really see a lot of our members continuing to be proactive in terms of taking care of their drivers from a compensation and benefits standpoint.”

See also: How to retain driver recruits

Further, to ensure its drivers’ voices are heard, Brakebush Transportation Inc. developed a driver advisory council, consisting of eight drivers from different locations, Schwersenska said. Before implementing new fleet-wide strategies or operations, Brakebush management consults this driver council. These drivers meet once a quarter, have discussions, and then help make decisions for the fleet.

“We've done a lot of [driver] outreach, we do a lot of surveys,” Schwersenska said. “We do that kind of stuff just to make sure that we're providing those drivers what they expect.”

This is part two of a two-part series about NPTC’s annual benchmarking survey. Read part one here.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.