How the freight recession made trucking less profitable

Key takeaways:

- Operational costs rose despite falling fuel prices, leading to reduced profit margins in the trucking industry.

- The Northeast experienced the highest operational costs, while the South Central U.S. was the least expensive, highlighting significant regional variations.

- Overall driver wages and benefits averaged 99.5 cents per mile, increasing by 2.9% from the previous year, with LTL drivers typically earning the most.

The pain of a yearslong trucking downturn is in full effect. Most operating costs in for-hire trucking continued to climb while margins shrank significantly in 2024. While average overall costs were stagnant, profits fell.

That’s according to the American Transportation Research Institute’s latest analysis of the operational costs of trucking, which breaks down a wealth of operational data from 2024 to detail costs and trends for the industry.

“The freight market recession that plagued 2023 persisted throughout 2024, once again despite an overall positive U.S. economy,” the report said. “While parts of the U.S. economy maintained positive growth rates, those sectors lacked the catalyst necessary to reverse the multiyear trucking downturn that followed the post-pandemic boom.”

Broadly, operational costs fell, due mainly to consistent drops in fuel prices. The average operational per-mile costs of trucking in 2024 decreased 1 cent when including fuel—from $2.27 per mile to $2.26. Excluding fuel, trucking costs actually rose 3.6%—from $1.717 per mile to $1.779.

Though the report does not track many indirect costs, such as non-driver payrolls or technology subscriptions, the authors noted that many of those additional costs also grew in 2024.

See also: As on-highway sales slump, DTNA sees opportunity for Western Star

Breaking down trucking’s costs

The average operational cost of for-hire trucking fell 1 cent to $2.26 per mile in 2024—but most types of expenses that ATRI tracked became more costly. Falling diesel and maintenance pricing outweighed all other rising costs. Excluding fuel, the operational cost for trucking grew by 3.6% to $1.779 per mile.

How did expenses change?

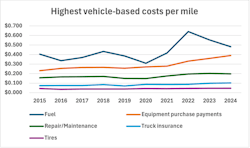

Fuel pricing was the most significant factor for the operational cost decrease. Fuel, the industry’s second-largest operational cost behind only driver wages, fell 13% from 55.3 cents per mile in 2023 to 48.1 cents per mile in 2024. Repair and maintenance pricing also weakened slightly, falling 2% from 20.2 cents to 19.8 cents. The average cost of permits and licenses remained flat year over year.

Every other category of expense in the report became more costly in 2024—and set record highs. Truck and trailer payments, truck insurance premiums, tires, tolls, driver wages, and driver benefits all became more expensive than any other year tracked by ATRI.

However, only three categories outpaced 2024’s consumer inflation rate of 2.9%: truck and trailer payments grew 8.3%, tolls grew by 11.8%, and driver benefits grew 4.8%.

In the longer term, ATRI’s measure of equipment payment costs and driver wages increased dramatically since 2019. Over the last five years, driver pay increased 44%, and equipment payments increased by a startling 52%.

Average costs by sector

Average operational costs naturally differed by operating sector.

Less-than-truckload operations remained the most expensive sector with an average cost of $2.02 per mile, excluding fuel, followed by specialized ($1.79 per mile) and truckload ($1.66).

The average costs of specialized and truckload operations grew at a greater rate, however. Specialized and truckload became 5% more expensive (excluding fuel) while LTL became only 1% more expensive.

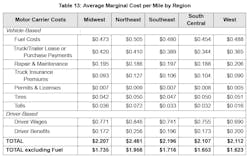

Average costs by region

ATRI noted that regional differences made a greater impact in 2024 than in any other recent year. Year-over-year operational cost changes were significantly different across the continental U.S.

The Northeast was the most expensive region among for-hire trucking operations by a wide margin, averaging $2.461 per mile (including fuel).

The Northeast was most expensive for almost every category of cost, excluding truck payments, repair/maintenance, and tires. For truck payments and tires, the Northeast region still bore the second-highest costs in the nation. Notably, Northeast insurance premiums were 24.5% above the national average, and driver benefits were 29.9% above the average.

The least costly region was the South Central U.S. when including fuel, or the West when excluding fuel.

South Central fuel costs and truck payments were the lowest of any region, with fuel costs at 5.6% below the national average and truck payments 11.8% below average.

The West’s trucking operations bore the lowest insurance premiums (24.5% below the national average) and driver wages (13.5% below average) but the highest repair/maintenance costs (11.8% above average) and tire costs (8.5% above average).

Driver compensation

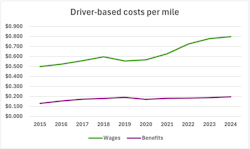

Driver wages continued to be the most cost-intensive part of trucking operations, averaging 79.8 cents per mile. Driver benefits averaged 19.7 cents per mile, remaining the fourth greatest per-mile cost in for-hire trucking. Combined, overall driver compensation averaged 99.5 cents per mile in 2024, 2.9% more than the prior year.

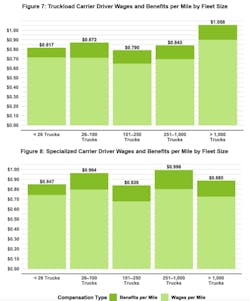

Beyond regional differences, driver wages and benefits also varied by fleet sector and size. LTL drivers generally earn the most with an average of 92.9 cents per mile. General truckload fleets with more than 1,000 trucks spent significantly more on driver wages than smaller-sized fleets across either truckload or specialized sectors.

Most carriers continued to offer several kinds of driver bonuses in 2024. Over 74% of carriers offered some type of bonus, mostly safety, starting, retention, and referral bonuses:

- Most common was the safety bonus: 58% of carriers offered safety bonuses with an average payout of $1,680.

- Starting bonuses were less common but paid more: 30% of carriers offered a starting bonus at an average of $2,122.

- 47% of carriers offered referral bonuses at an average $1,738.

- 19% of carriers offered retention bonuses, averaging $1,832.

Driver turnover increased for the second year in a row. ATRI found that the industry’s average driver turnover rate was 48% in 2024, slightly higher than 2023’s average of 46.6%. Similar to previous years, turnover was higher among larger carriers and less pronounced in specialized sectors.

Weaker margins across the board

The profitability of for-hire trucking was significantly challenged last year.

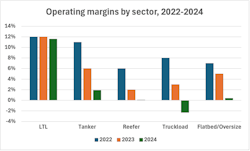

Continuing a multiyear trend, operating margins in 2024 shrank across every sector recorded by ATRI—and, for the dry van truckload sector, average margins even fell negative.

“Financial results in the trucking industry were poor,” the authors said. “The 2024 freight market combined doggedly high costs with persistently depressed rates.”

Operating margins were highest among participating LTL fleets (11.6%) and second-highest for tanker fleets (1.9%), while margins were lowest for dry van truckload fleets (-2.3%).

The report’s authors said that 2024’s margin averages “represent the full brunt of the freight recession” as the benefits of 2022’s strong start and 2023’s remaining favorable contracts dwindled.

Uncertainty remains for 2025 profitability

“Economic conditions in the trucking industry continue to appear uncertain at best for the foreseeable future,” the report’s authors said. They noted that GDP slipped negatively in the first quarter of 2025 due primarily to a surge in imports—which, unfortunately, still did not significantly boost freight rates.

Other industry experts, such as FTR Transportation Intelligence in its recent State of Freight webinar, predict freight demand to remain close to flat in 2025 and 2026. FTR forecasted dry van truck loadings to dip by 0.9% year over year in 2025, truck utilization to continue hovering around 92-94%, and truckload contract rates to increase tepidly below 2% year over year, likely remaining below inflation rates.

On the bright side, however, fuel costs could continue to drop. ATRI noted that the U.S. Energy Information Administration forecasts highway diesel prices to continue to decline in 2025, potentially bringing the industry’s fuel costs below 45 cents per mile.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.