Key takeaways:

- Fuel cards provide fleet managers with insights into efficiency, improved expense tracking, and better budgeting, addressing various operational challenges.

- Modern fuel cards like the Shell Card offer advanced security features to prevent fraud and unauthorized usage, addressing key concerns for fleet managers.

- Large fleets focus on operational efficiency and security, while small businesses prioritize cost control and may need more support with reporting and compliance.

It’s hardly news that controlling fuel costs, both tracking and forecasting, is among the top benefits cited by fleet managers who use fuel cards. But surprisingly, according to a new survey from Shell Fleet Solutions, more than 1 in 3 fleet managers still don’t use fuel cards at all.

And, based on the latest State of Fleet Cards Report, they don’t know what they’re missing. Modern fuel cards now provide much more than a convenient way for drivers to top off a tank: They are a key that unlocks a wide range of tools, simplifying fleet management with an all-in-one solution for comprehensive cost control, data security, electrification, and actionable insights.

Holistic cost controls

While fuel is a significant expense, the strategic value of fuel cards extends far beyond pump discounts. Fleet managers overwhelmingly agree (95%) that fuel cards provide valuable insights into a fleet’s efficiency. The sentiment is consistent across both large and small enterprises.

The survey reveals that fleet managers' primary cost challenges are multifaceted. Beyond fuel price, modern fuel cards address a range of financial and operational concerns by:

- Enabling better expense tracking (49% cited as a benefit).

- Improving budgeting and cost forecasting (47%).

- Providing spending controls and setting limits per card (43%).

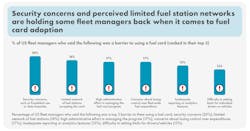

- Enhancing security features to prevent fraud (40%) and controlling unauthorized fuel usage (40%). This is crucial given that security concerns, such as fraudulent use and data breaches, are a top barrier to adoption (20%). Modern solutions like the Shell Card employ encryption standards and require Level III data (odometer readings, driver ID, vehicle identification numbers) to combat fraud and improve visibility.

- Reducing administrative workload for fuel expense management (37%). A significant portion of fleet managers still manage expenses manually, with one in four using spreadsheets and another one in four relying on paper records. Fuel cards facilitate a transition to a fully secure, digital solution.

- Providing comprehensive reporting and data insights on fuel consumption (32%). The complexity in consolidating fuel data for analysis is a major struggle for 28% of managers, indicating a clear need for digital solutions to streamline tracking.

- Streamlining tax reclaim processes (29%).

What about electrification?

Fuel cards, likewise, are becoming a crucial tool for electrification and sustainability efforts, offering support for decarbonization initiatives (26%). For example, the Shell Card Business Flex grants access to public EV charging networks and supports at-home EV charging with residential electricity rates.

For large fleet customers, Shell Fleet Solutions also offers the Accelerate to Zero program, providing guidance for customers to hit sustainability targets while still boosting fleet performance and efficiency.

Large vs. small fleets

While 62% of fleet managers currently use fuel cards, with large fleets (70%) adopting them at a higher rate than small businesses (60%), their specific needs and challenges often differ.

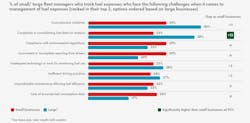

Large fleets:

- Tend to adopt fuel cards more readily.

- Prioritize operational efficiency and security, focusing on improved control over unauthorized fuel usage (55%), integration with fleet management systems (47%), and access to a wide fuel station network (45%).

- Face significantly greater challenges with cost reduction initiatives (40% vs. 29% for small businesses) and complexity in consolidating fuel data for analysis (38% vs. 25% for small businesses). They may have better consolidated data but struggle with resources to leverage it.

Small businesses:

- Primarily prioritize the direct cost control aspect of fuel cards.

- May need more support with compliance, driver accountability, and better reporting tools. Challenges like inconsistent or incomplete driver reporting and lack of accurate fuel consumption data are less prevalent in larger fleets, suggesting small businesses face these more.

See the complete whitepaper and survey results here: State of Fleet Cards Report.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.