A deep dive into Fullbay’s 2021 State of Heavy-Duty Repair

Fullbay has released its 2021 State of Heavy-Duty Repair report to shed light on an essential, but often overlooked, industry: heavy-duty repair. With both qualitative and quantitative data, the report gathers insights, trends, and benchmarks for the space. Fullbay’s Founder and CEO Jacob Findlay shared his thoughts on the results as well as his advice for shop owners.

The report, which includes both Fullbay users and non-users, covers nine important sections: responder demographics, shop demographics, driving into repairs, shop talk, COVID-19 impact, inventory management, technicians, tech hiring and shortage, and shop technology and software.

When designing the report, Findlay explained that they posed questions a shop that doesn’t use Fullbay could answer.

“We didn’t want it to be too biased towards shops that are using our software,” Findlay said. “For example, 16% of shops reported that they never count their inventory. I think the reality of the industry is actually a little higher than that, so one of the limitations of the report is that the people using our software tend to have slightly better practices because we make it easy for them. We wanted to survey the industry because we wanted that color from shops who aren’t using our software.”

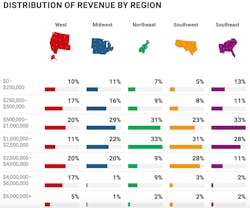

According to the report, nearly half the repair shops in the country take in between $500,000 and $2 million gross revenue per year. There are outliers on either side of that; 9% of shops see gross revenue of $250,000 or less, whereas 18% took in up to $4 million per year.

The report also pointed out that the net profit in repair shops across the country falls between 5-20%. That does, however, leave out the 20% of shops that aren’t sure what their net profit is.

Findlay explained that Fullbay provides end-to-end management for the commercial repair shop, not to the fleet directly.

“There are 1.7 million fleets out there, approximately, based on the FMCSA database,” said Findlay. “Most of them are very small – not big enough to even have their own shop or someone on the inside who is managing the preventive maintenance or service history compliance – all these laws that govern the records they have to keep for the Department of Transportation (DOT).

“What a lot of the commercial repair shops, whose customers are the fleets, will do is they will take over the tracking of things like their oil changes, all the preventive maintenance for the fleet, keep them in compliance,” added Findlay. “Fullbay gives them the tools – the end-to-end management – to do that, and it makes it so the shop has this steady stream of work coming in. This way, fleets don’t have to worry about their oil changes being done on time, the shop has revenue coming in, and Fullbay helps create that relationship.”

According to Findlay, about 80% of repair shops are independently owned while 20% are fleet-owned. However that 20% is rising.

“More and more fleets are creating their own internal repair shops,” Findlay added. “And we definitely recommend that fleets open their own internal shop. It can help diversify their business, and it’ll also have the added effect of making their operation more efficient because now they have an opportunity cost introduced.

“For example, they could have their technician, in a worst-case scenario, spending 10 hours to do a five-hour repair, but we could also do another 10 hours of work for a customer that comes in the door, and now we have to say, ‘Well, we better make sure he’s doing that repair in five hours, so we can go serve this customer.’ The cost is the same, we’re still paying the technician 40 hours a week, but now we have revenue coming in the door and the added benefit of our truck getting done faster and we can put it to use making money sooner,” explained Findlay.

For fleets who source independent repair shops to maintain their vehicles, Findlay believes that Fullbay’s 2021 State of Heavy-Duty Repair report can help those fleets understand the shops that serve them better.

“There’s a lot going on in the shop world that they might not be aware of,” Findlay added. “A lot of fleets run their own internal shops and so some of the benchmarks we’re covering can help them measure the effectiveness of their internal operations. So maybe they’re not repairing other people’s vehicles for profit, but they’re still repairing their own vehicles and maintaining them. So there’s plenty of beneficial information in the report for fleets that are running their own internal shop. A lot of fleets may be considering doing that – hiring some technicians for their own internal work.”

A surprising statistic in the report – 16% of shops who never count their inventory – wasn’t all that surprising to Findlay.

“I think the biggest one that – it wasn’t surprising to me, but it’s always disappointing to see – was the metric around shops counting their inventory,” said Findlay. “I’m an accountant at heart, and you want to see people taking good care of their assets. Basic best practices like that, it’s a pleasure for us to provide a service [through Fullbay] to make life easier for shops.”

Because Fullbay happened to conduct data collection during 2020, when COVID-19 hit, the company was in a unique position to benchmark how did COVID-19 impact the industry.

“We divided this section by region, showing that the Midwest did pretty well in recovering from COVID-19 about halfway through the year, but the Southwest was just negative all the way through the year. That was pretty interesting to see,” said Findlay. “We’ve been doing some light surveying of our customers since then, and we’ve seen that the majority of them do expect 2021 revenue to be higher than last year.”

Outside of COVID-19, Findlay revealed that the biggest challenge shops faced is finding technicians.

“While there’s a driver shortage in the transportation and logistics industry, there’s also a technician shortage,” Findlay explained. “It’s part of the greater skills gap that we see out in the workforce. Finding qualified technicians – not just technicians, but qualified technicians. A common misconception is that shops are looking for more work, but in fact they’re turning away work left and right because they don’t have enough technicians.”

According to the report, the vast majority of shops – 73% – employ between 2–10 technicians while 36% employ between 6-10.

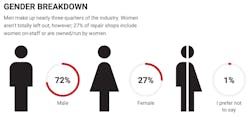

Findlay also stated a shocking statistic from the report was the representation of women in repair shops.

“In a shop, 25% of employees are women; however, you don’t see technician register in the top five female roles. In reality, less than 1% of technicians are women,” Findlay stated. “The skillset that is required to be a technician, the problem solving and diagnostic skillset, it’s not just about lifting really heavy things, which people would think would maybe exclude women from being interested, but there’s a lot of stuff that happens in the bay that could absolutely be done by anybody – not just a man.”

According to Findlay, Fullbay created this report to bring shop owners together because often times, commercial repair shop owners tend to be lonely.

“They feel isolated without a network to lean on to learn and grow their business,” Findlay explained. “We are encouraging independent repair shop owners to join Technology and Maintenance Council, the trade organization for fleets. TMC wants independent repair shops to be a part [of the conversation], but most shops don’t know about it.”

Findlay added that one of the benefits of Fullbay partnering with TMC on the report was to get the word out to the shops about TMC, so they can be brought into the fold.

“They can learn best practices on how to run a shop that would only benefit their customers and fleets,” Findlay continued. “I think it would be beneficial to shops to join, so that they don’t feel lonely. The report gives them a taste of what it's like to not be lonely, but joining TMC would be more permanent.”

Fullbay is constantly monitoring how trends are changing. Findlay said that the company could release a mid-year report if there is a particular trend that’s changing drastically between now and 2022.

Check out the full report from Fullbay's 2021 State of Heavy-Duty Repair.

This article originally appeared on Fleet Maintenance.

About the Author

Catharine Conway

Digital Editor

Catharine Conway is a past FleetOwner digital editor who wrote for the publication from 2018 to 2022.