Four lessons from private fleets on how to reduce turnover and boost operations

Key takeaways

- Private fleets thrive by controlling supply chains, reducing miles, and boosting safety amid prolonged freight recessions.

- Investing in drivers—pay, support, and career growth—cuts turnover, strengthens operations, and improves fleet stability.

- Technology, strategic facility placement, and safety commitment drive efficiency

These are the times that try fleets’ souls.

With apologies to Thomas Paine’s 249-year-old prose, the sentiment feels apt for today’s trucking industry. For-hire carriers are grappling with this prolonged freight recession, but private fleets are showing remarkable strength and resilience because of smart business decisions made years ago. Those decisions included investing in their people to reduce turnover, in equipment to improve efficiency and safety, and in operations to improve productivity.

While the longest freight recessions in generations continue to putter out and the for-hire carrier market’s capacity remains high, private fleets are still in control of their parent company’s supply chains, putting fewer miles on their equipment, getting more drivers home, and improving safety, according to the latest National Private Truck Council’s Benchmarking Survey Report.

“There are still too many trucks chasing—I don’t want to say too little freight. There’s plenty of freight. There are just too many trucks,” noted Jim Lager, EVP of Penske Truck Leasing, during a recent briefing on the NPTC 2025 benchmarking report.

Lager, whose company sponsored the report, said the freight recession is forcing fleets to revisit their strategies to find any edge. This is something that private fleets led during the pandemic, as their parent companies sought greater supply chain control after seeing what could happen if they relied too much on contracted carriers. That forward thinking from years ago continues to pay off for the companies that invested in their own transportation networks.

The data displayed in this year’s benchmarking report offers four lessons from the 104 NPTC member fleets that participated by sharing operational data.

1. Leveraging strategic fleet growth to control supply chains and maximize operational efficiency

The first lesson is about embracing control and strategic growth. Tom Moore, NPTC executive director and editor of the Benchmarking Report, referred to this focus as “a return on value invested by parent companies.”

The 2025 survey confirms this strategy is working, Gary Petty, NPTC’s chief executive, told industry journalists earlier this month. More than three-quarters of the surveyed private fleets reported increasing shipments, volumes, and value for 11 consecutive years.

Mike Schwersenska, VP of transportation for Brakebush Transportation, underscored the importance of control, particularly when handling perishable commodities like the chicken his fleet moves nationwide for parent company Brakebush.

See also: How Brakebush Transportation created a century of service

Wegmans Food Markets has been increasing its footprint from the Northeast to the lower Mid-Atlantic in recent years. The popular grocery chain has succeeded in large part due to its well-planned transportation network, which it has invested in as the retail side of the business expanded.

“From a Wegmans standpoint, we’ve always had a clear path for slow, steady growth,” David Barth, transportation safety manager for Wegmans and NPTC chairman, said. “A lot of the increase in the volume we’re seeing is certainly through growing our own network of stores and moving into new markets. The fact of the matter is, we want our drivers handling the majority of that freight because nobody can handle that work as well as our professional drivers.”

2. Reducing driver turnover: Investing in talent, pay, and support for fleet stability

Speaking of drivers, how private fleets invest in people is another lesson our entire industry can learn from. While fleets of all kinds experience driver turnover, the rate for private fleets dropped back below 20% last year. The surveyed fleets employ about 35,000 drivers. Moore noted that when medium-duty drivers are removed from the figures, the Class 8 driver turnover rate falls to 17%.

“Our private fleets are doing a better job of understanding the true cost of turnover,” Moore said. He explained that these companies are recognizing the value in reducing turnover by building up better support systems for employees.

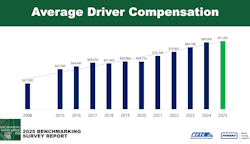

A lot of that support comes from good pay. Ten years ago, the average private fleet driver made $62,000 annually. This year, it topped $90,000 for the first time in the survey's history. Good pay, good support, and sound equipment create staff stability.

Wegmans’ Barth noted his fleet’s turnover is below 10%, caused mainly by retirements.

3. Integrating advanced fleet technologies to boost efficiency and lower operational costs

The third lesson is about leveraging technology and efficiency. “Use of advanced technology, without a doubt, is the highest in the industry,” Petty said of his membership.

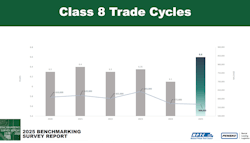

While private fleets’ Class 8 trade cycles average about 6.6 years, the fleets are putting fewer miles on their equipment as they’ve moved distribution centers and operations closer to their customers. In 2024, the average heavy-duty truck traveled 80,400 miles—down from 85,000 in 2023 and 91,600 in 2019.

Opening a new Wegmans distribution center in Virginia in 2024 to get closer to Mid-Atlantic stores had an “enormous impact on the number of miles we’re driving,” Barth noted. “It’s a conscious business decision that has certainly paid dividends for us.”

Asking your drivers to put fewer miles on vehicles with more safety technology leads to fewer accidents and more efficient operations.

4. Prioritizing fleet safety: Best practices to protect drivers, cargo, and company performance

Perhaps the most compelling lesson from NPTC for trucking is its members’ unwavering commitment to safety. “If it’s not safe, it’s not going to be efficient,” Moore, who has been editing the Benchmarking Report for 18 years, told me.

Private fleets are three times safer than the average motor carrier, according to the Federal Motor Carrier Safety Administration. And that’s not by accident; it’s something that NPTC members collaborate on all year long. “Safety is not a strategic advantage,” Schwersenska said. “So we try to make sure that we’re sharing as many good practices as possible, including what works and what doesn’t.”

The entire trucking industry is facing countless headwinds. But NPTC’s members’ planning, investments, collaboration, and people are proving to companies that transportation control, efficiency, driver support, and safety are the surest path forward.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.