What's a fair way for EVs to pay their fair share for highways?

The American Trucking Associations has long supported fuel taxes as the best way to pay for highway infrastructure. That's how the Highway Trust Fund is set up—the tax is a fair and straightforward way to estimate vehicle usage, and the collection mechanism is in place and highly efficient.

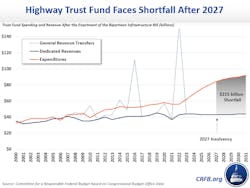

Since Congress has been unwilling to raise the "gas tax" for decades (despite big trucking's relentless proclamation that the industry supports an increase and is willing to pay its fair share), highway construction and maintenance costs have wildly outpaced the fund, leading to calls for new assessment and collection methods such as tolls on federal highways and vehicle miles traveled taxes.

And while ATA has been busy putting out those policy fires, the organization's advocacy efforts are really heating up now that electric vehicles—which don't use gasoline or diesel, and so ride the roads for free—are a rapidly growing reality.

To inform its membership and guide policy decisions, ATA's Joint Highway Policy/Tax Policy Committee invited several experts representing a range of interests in EV evolution to provide updates during the committee's meeting at the recent ATA Management Conference & Exhibition in Austin, Texas.

The session sparked a great deal of discussion, so to speak.

Wayne Weikel, VP of state affairs at the Alliance for Automotive Innovation, provided the thinking from major light-duty OEMs and their top suppliers in the EV space.

"The problem with roadway funding so far has not been EVs—yet," Weikel said, "but it will be soon. This problem for state legislators is growing, and growing really quickly."

See also: Environmental 'extremists' threaten U.S. economy, warns ATA leader

The trajectories were essentially the same, with light-duty vehicles hitting 100%, while the Class 4-8 line lagged a little into the late 2020s but quickly caught up, rising to 75%.

"That's the California medium- and heavy-duty mandate that other states are now starting to follow," he said. "So consider us [light-duty vehicles] the canary in the coal mine. People will start looking to you [trucking] for the same questions they've been looking to us for."

See also: EV transition: Fleets' very worried' about coming decade

"I have spent the last decade going all around the country, telling state legislators that EVs are the worst way to fund roadway infrastructure," Weikel said, then he quipped, "You wonder why there's no EV fees in the Northeast? I've worked for the last 10 years in the Northeast."

His main argument was simple: An additional EV sales tax is a disincentive.

"These people are already paying more money to buy an EV, to do the right thing, the green thing," he said. "It's not just coming up with your registration fee and your taxes—now there's another fee on top of that."

Electric vehicle highway fee options

Weikel then made his case for the three main options and noted that he's routinely confronted with edge cases that won't work in many of the scenarios.

EV fees are the worst way to fund roadway infrastructure

Pros:

- None

Cons:

- A regressive tax unrelated to the usage of fuel or public good

- Financial hardship, as collected all at one time

- It does not capture non-resident usage of roadways

- Disincentive to purchasing EV

- Adds to the upfront money consumers need to purchase EVs

VMT offers a new path to capture the actual usage of public good

Pros:

- A progressive tax that increases with more usage of road/fuel

- Not increasing upfront money needed to buy a vehicle

Cons:

- It does not capture non-resident usage of roadways

- GPS tracking is needed to offset out-of-state driving

- The principle vehicle owners do not generally like the principle of VMT

Kilowatt/hour taxes may be a better progressive tax.

Pros:

- Progressive tax ties road user contributions to the amount of fuel used

- Captures non-residents using in-state EVSE

- Tax on the volume of fuel used is most similar to the current gas tax rationale

Cons:

- Challenges and cost of segmenting electricity in a residential setting

- It introduces the same GPS and tracking concerns if pulled from a vehicle

Additionally, an EV tax on electricity consumption means changes to utility rate structures, and that's a "long and tortured path."

But here's the thing: After tossing around scenarios and debating outcomes, the alliance has changed its tune, or at least decided not to dismiss EV fees so quickly.

"We've come to a new conclusion that maybe a reasonable EV fee isn't the worst thing in the world," he said. "We have now taken a full 180-degree position change on this."

The EV fees re-think:

- Shortest ramp-up time to add revenue to state budgets

- The lowest administrative costs for a state to assess and collect

- Known and stable revenue expectations

- There is no GPS tracking and no added costs on infrastructure

In conclusion, Weigle suggested that it is "irresponsible" for EVs to pay nothing in the way of road-use fees. And he reminded the truckers in the room that "this conversation is coming for you as well."

"It may not be your conversation yet, with all the taxes that medium- and heavy-duty trucks pay now," he said. "Maybe you're thinking that you'll do the right thing and buy this green EV truck and try it out. But don't think that just because you paid a third more for that vehicle that, they aren't going to also want you to pay into the roadway."

Light-duty EV data

The alliance issues quarterly reports that detail EV sales and adoption rates that is packed with state-by-state data. Readers of this blog might recall that charging capacity (and therefore electricity generation capacity) is a huge concern. The report offers some insight:

Public EV charging still lags; gap widens

- Installation of U.S. public chargers is not keeping up with current and projected EV sales.

Electricity usage will jump; grid modernization required

Read the full Q2 2023 Get Connected Electric Vehicle Report.

Up next: The ATA Highway Policy Committee hears from a transportation planning coalition working to develop a milage-based user fee schedule for commercial vehicles. The good news: the group realizes that "trucks are not big cars" and has developed a pilot program and formed a Motor Carrier Working Group to guide their efforts.

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.