SONOMA, California—The transition to battery electric vehicles, especially on the trucking side, is being driven by a combination of mandates and faith.

While fleets have expressed some doubt about the narrow focus and aggressive timelines of policymakers and regulators, truck manufacturers—particularly the traditional OEMs with a century-old legacy of customer support—have taken the transition challenge head on: If customers have questions, the OEMs must have answers. And if they must develop new areas of expertise (and partnerships) to sell trucks, you can be sure that’s what they’re going to do.

On the fleet side, where a fraction of a penny per mile is the difference between a profit and a loss, the array of unknowns surrounding new technologies and the ensuing operational shifts are a cause for concern—to put it mildly.

The big questions are basic: When will zero emissions vehicles be available, how much is a new truck going to cost, and how well will it perform compared to legacy diesel powertrains? And how will these vehicles be charged/fueled?

See also: Two fleets weigh in on their EV transition progress

Ironically, at this point, electric trucks are the easy (well, easier) part: Established truck builders know how to build trucks, and the global OEM giants and supplier partners have applied vast resources: The road-ready lineup is growing rapidly, and customers have been impressed (based on numerous customer events FleetOwner has been allowed to sit in on).

But that exciting new technology won’t go anywhere without juice.

So, at a Mack Trucks EV event here this week, I continued to ask my basic question: How can customers make the investments they need to support the ZEV transition when they don’t know what they don’t know?

More specifically, how can anyone calculate total cost of ownership (TCO) with so many unknowns?

Charging ahead

As mentioned previously here, Mack sees a competitive advantage in their charging infrastructure partnerships and innovative financing for their electric trucks.

Ryan Saba, Mack’s energy solutions manager—electromobility, consults with customers on their charging needs.

“The challenge is that every business is different and their operational goals vary. Or they have similar needs, but they face different internal challenges,” he said. “So, for us, it's having the right mix of strategic partners in our portfolio to be able to support that transition for the customer. They know that Mack is a trusted source.”

See also: Roeth: Is emerging trucking tech pulling you in too many directions?

Saba explained that the customers his team works with fall into three categories:

- those who will handle their charging plans themselves, and only need some technical information to get started

- those who want Mack to work with them, to provide a more consultative approach and guide the development and implementation

- those who want a complete turnkey solution, or for Mack “to do it for them”

Most customers, so far, need help, he added.

“It depends on the size of the fleet and what their sustainability goals as an organization are,” Saba said. “What we generally see is most customers want to start small, to bring on one, two, three, four trucks just to see how it fits into operations. There’s a lot of anxiety associated with the range and a number of different things. Once they see how it fits into their operations, and that their drivers love it, then they get comfortable with it, their customers get comfortable with it—and you really start to see adoption catapult after that.”

Blink Charging, a global EV charging equipment supplier, was among the Mack partners on hand for the media day ahead of dealer and customer demonstrations this week. Aaron Muellerleile, Blink sales manager for Northern California, explained his role is to guide someone who might not even know “what questions to ask” as they plan charging infrastructure.

“I’m going to narrow in on what's going to be best for you and your organization,” Muellerleile said. “How many trucks do you have and how many miles a day do these trucks drive? Are they going to be parked behind the fence for 10 hours until they leave again the next morning? Do you have the power you need at your site? That's where we come in and do caseload studies to make sure you have the infrastructure in place.”

See also: Truck charging in the 'real world'

Muellerleile recalled his time in fleet sales with GM—and his having to get past the idea that he’d convert all 100 Ford trucks in a construction fleet to GM in one deal.

“But, no, you're going start with a couple,” he said, likening EV adoption to the incremental process. “When the customer decides these trucks are better for my workload and it’s time to buy two, three more new ones, then you have a deal. It's not all at once.”

Even though EV charging has been around for 15 years, most people still consider it a “relatively new” technology, Blink’s Muellerleile added—and that’s a hurdle for the transition.

“The hard part is getting the buy-in and the adoption from the people that are against it,” he said. “They need to understand that this is, one, a mandate that we have to switch to EVs. And then the infrastructure costs: When people don't want to do things or they don't understand it, cost is a big prohibitive factor.”

TCO calculus

Indeed, depending on how a business values and supports its sustainability goals, understanding the initial costs and then managing the payback period are critical to the adoption of EVs—or would be, except for the mandates.

That’s why Mack has rolled out its “pay as you go” mileage-based plan for Mack MD Electric. Basically, ElectriFi Subscription is designed to minimize upfront costs and take some of the sting out of getting started with EVs., as George Fotopoulos, Mack VP of e-mobility business unit leader, told FleetOwner.

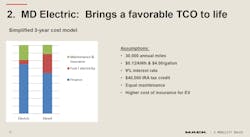

The good news: Mack has crunched some numbers, and a basic calculation shows that the MD Electric’s TCO becomes favorable after three years, at 30,000 annual miles.

Of course, the better a fleet knows its current operational data and costs, the more precisely the TCO turnaround for EVs can be calculated. To that end, Mack has worked with an outside consulting firm to come up with a comprehensive form for understanding costs, Fotopoulos explained.

“They sat down with us for a couple of months and came out with a spreadsheet that is beyond belief—all the inputs, all the fleet expenses,” he said. “It’s a model that is very intense, has every variable that you can think of under the sun. It's just a longer exercise that could confuse the less sophisticated customers.”

The variables range from hourly shop rates to tire wear and about anything else associated with the cost of operating the current diesel fleet. And it’s only when a fleet really understands those costs that the benefits of EVs can be weighed.

Of course, electric commercial vehicles don’t have enough history to lock-in long-term cost trends but, again, the big OEMs have resources—and the long-term goal is to win EV business now.

See also: EV transition: Fleets 'very worried' about coming decade

“We have a bunch of smart financial analysts that can try to predict what the resale would be five years from now, but nobody's going to know until five years from now,” Fotopoulos said. “So we are taking more risks—there are a lot of big unknowns around what's happening five years from now. We're also taking that financial risk on the charging. Mack Financial Services is giving loans on the infrastructure. Let's bring in a construction company to dig a hole and put copper in the ground. Guess what? Don't let it come out of your pocket—we'll take the risk for it.”

Whether the customer already buys Macks or not, fleets are looking for the same things, Saba suggested.

“They're coming to the OEM as a partner in the transition,” he said. “So if you're able to provide a safe, reliable, consistent vehicle that meets the expectations, and you provide real transparency around how we expect it to perform within their operations, and also provide reliable charging infrastructure, we see it as an opportunity to cement a strategic relationship moving forward.

“This is such a seismic shift in our industry that, if they find somebody that they can really trust and who meets or exceeds their expectations, that's going to be their electromobility transition partner for the duration. That is our goal.”

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.