DAT: Reefers, dry vans level out as flatbed freight market jumps

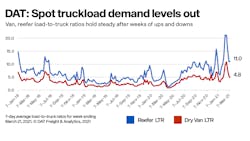

Truckload van and refrigerated freight volumes leveled off while the flatbed load-to-truck ratio jumped sharply in mid-March, said DAT Freight & Analytics, which operates the industry’s largest load board network.

The total number of loads posted to the DAT network increased 0.7% and the number of trucks dipped 1.3% week over week; rates held steady for van and reefer freight while flatbed pricing reflected strong demand for trucks.

National average spot rates, March

- Van: $2.68 per mile, 28 cents higher than the February average

- Flatbed: $2.73 per mile, 17 cents higher than February

- Refrigerated: $2.94 per mile, 25 cents higher than February

These are national average spot truckload rates for the month through March 21 and include a calculated fuel surcharge. The national average price of diesel was $3.19 a gallon last week, up 1.6% week over week.

The reefer load-to-truck ratio was unchanged at 11.0: The number of loads moved on DAT’s top 72 reefer lanes by volume was up 2.7% compared to the previous week. The average rate was higher on 36 of those lanes, neutral on 16, and lower on 20 lanes.

California continues to drive the reefer market: Los Angeles outbound averaged $3.88 a mile on a 4.7% increase in volume compared to the previous week while Ontario averaged $3.63 per mile on 8.7% more volume. Stockton averaged $3.22 a mile, a 13-cent increase week over week on 6.7% more volume.

Reefer lanes to watch: Two major ports for temperature-controlled goods, Philadelphia and Elizabeth, NJ, are producing strong rates to Boston. Elizabeth to Boston averaged $6.05 a mile, a 15-cent increase week over week, while Philadelphia to Boston averaged $5.24 a mile, up 10 cents on similar volume. Atlanta to Lakeland averaged $3.88 a mile, a 10-cent increase compared to the previous week. Load volumes from Tucson AZ tumbled 7% and the average outbound spot rate fell 13 cents to $2.86 a mile.

Flatbed loads keep building: Flatbed load post volumes continue to build as construction activity and manufacturing pick up. The national average flatbed load-to-truck ratio was up from 77.6 to 86.5 last week and the average spot rate increased on 41 of DAT’s top 78 flatbed lanes by volume. Twenty-three lanes were neutral and 14 lanes declined compared to the previous week.

Flatbed lanes to watch: The country’s high-volume flatbed lane last week was Lakeland, Fla., to Miami, averaging $3.13 a mile, down 2 cents week over week. That’s better than the average outbound rate from Lakeland, $2.42 a mile. Houston to Dallas averaged $2.77 a mile, up 11 cents compared to the previous week and 14 cents higher than the average outbound rate from Houston. Los Angeles to Phoenix jumped 9 cents to $3.40 a mile while Phoenix to Ontario was up 20 cents to $2.70 a mile.

For van carriers, pricing power remains solid: While rates are high for the time of year, data indicates a plateau in demand for trucks. Rates were lower on 55 of DAT’s top 100 lanes and higher on 24 lanes, and overall volume on those 100 lanes was up just 1% week over week. The national average van load-to-truck ratio fell from 5.4 to 4.8.

Van lanes to watch: The spot van rate from Los Angeles to Stockton averaged $3.60 a mile last week, 5 cents more than the previous week and up 24 cents compared to the last week of February. For all outbound loads, Los Angeles averaged $3.27 a mile, down 5 cents compared to the previous week. Allentown, Penn., to Boston averaged $4.98 a mile and has lingered around $5 for the last four weeks. The jump in rates from Memphis to Charlotte, N.C., outpaced all major van lanes with an increase of 23 cents to $3.41 a mile last week. All told, Memphis averaged $3.35 a mile outbound for spot van freight last week.

Visit dat.com/trendlines for more information.