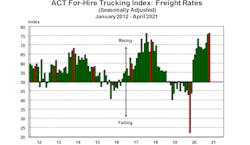

ACT’s For-Hire Trucking Index achieves ‘strongest pricing ever’

The latest release of ACT Research’s For-Hire Trucking Index, with April data, showed a slowing in volumes, strength in pricing, and a supply-demand balance that is still tight, but beginning to show early signs of rebalancing.

The ACT For-Hire Trucking Index is a monthly survey of for-hire trucking service providers. ACT converts responses into diffusion indexes, where the neutral or flat activity level is 50.

“The Volume Index decelerated in April, after surging to a five-month high in March,” said Tim Denoyer, ACT’s vice president and senior analyst. “Some of the strength was make-up for the polar vortex-impacted February level, but this slower growth also likely reflects ongoing supply constraints and the deepening semiconductor shortage.

“And with both driver and equipment capacity in short supply, we are witnessing the strongest rate environment in survey history, even with a bit slower volumes.”

Regarding the supply-demand balance, Denoyer added: “The supply chain constraints imply pent-up demand is still building, and the near-term freight volume outlook remains very positive. This should keep the market tight, but we expect the rebalancing trend to continue in the medium-term.

“The risks are that substitution back to service spending gradually cools the freight volume environment and that the eventual end of extended unemployment insurance helps driver availability improve.”

The ACT Freight Forecast provides forecasts for the direction of truck volumes and contract rates quarterly through 2020, with three years of annual forecasts for the truckload, less-than-truckload and intermodal segments of the transportation industry. For the truckload spot market, the report provides forecasts for the next 12 months. In 2019, the average accuracy of the report’s truckload spot rate forecasts was 98%.

Visit actresearch.net for more information.