Spot market freight volume remains high in May 2014

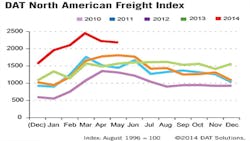

Spot market freight availability as measured by the DAT North American Freight Index has run high since July 2013 due to various factors including extraordinary weather events, regulatory changes, and driver shortages.

May 2014 numbers extend the trend, becoming the 11th consecutive month to post a year-over-year record high with a 40% increase over May 2013. Month over month, however, May freight volumes declined 2.1% compared with April’s.

Freight for vans, the predominant equipment category, was up 25%, refrigerated (reefer) freight increased 18%, and flatbed freight volume rose 85% versus May 2013. Month-over-month van freight availability was fairly stable with a 1.0% decline, while reefer freight dropped 4.8% and flatbed volume lost 1.6%.

The increase in freight, together with capacity constraints, added pressure to rates. Compared with May 2013, van rates rose 18%, reefers added 20%, and flatbeds commanded a 12% increase. Month over month, rates declined 2.0% for vans while reefers received a 3.4% rate increase and flatbed rates climbed 1.1%.

Reference rates are derived from DAT RateView. Rates are cited for linehaul only, excluding fuel surcharges, which declined on a month-over-month basis but increased compared with May 2013. The monthly DAT North American Freight Index reflects spot market freight availability on the DAT Network of load boards in the United States and Canada.

Portland OR-based DAT Solutions operates a network of load boards and is a source of supply and demand trends, rate benchmarking, and capacity planning information. Related services include a directory of companies with business history, credit, safety, insurance and company reviews; broker transportation management software; fuel tax, mileage, vehicle licensing, and registration services; mobile resource management; and carrier onboarding.

Access www.dat.com for more information.