Intermodal industry volume rebounds in second quarter

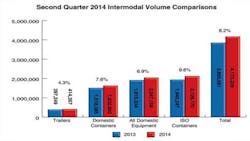

In a strong second quarter showing, intermodal posted gains across all segments, according to the Intermodal Association of North America’s (IANA) Intermodal Market Trends & Statistics report.

International containers increased 9.6%, trailers improved by 4.3%, and domestic containers grew 7.6% quarter over quarter, all indications that the intermodal industry is recovering from a harsh winter and a contracted economy. Due in large part to Q2’s strength, the first half of 2014 averaged 5.5% in total intermodal volume gains, just below the 5.8% growth recorded in the second half of 2013 and in-line with recent trends.

“The second quarter results were indicative of a rebounding economy and higher-than-predicted import shipments,” said Joni Casey, president and chief executive officer of IANA. “It is also probable the harsh winter that resulted in constricted Q1 capacity contributed to the second quarter’s strong growth, by comparison.”

The seven highest-density trade corridors, accounting for 66.2% of total intermodal volume, rose 7.4% this quarter, falling below the 8.2% industry average. Five of the seven bi-directional lanes recorded growth near or above industry averages. The Trans-Canada corridor, positively impacted by international intermodal shipments from Eastern Canada to Western Canada, led the way in corridor growth with a 10.5% quarter-over-quarter increase.

Eight of the nine IANA regions experienced growth in the second quarter, with six areas reporting increases larger than 10%. Of these six, all were heavily impacted by strong showings in international intermodal shipments. The Midwest and Southwest, the two largest IANA regions accounting for almost 50% of total loadings, climbed 6.3% and 7.8%, respectively.

Intermodal marketing companies (IMCs) posted Q2 growth rates that were more modest than the overall intermodal volume numbers, growing 2.4% from 2013. Like much of the broader market, IMCs in part benefited from the robust showing from imports based on transloading opportunities. Average revenue for both intermodal and highway IMC market segments continued its strong growth, with increases of 6.0% and 16.3%, respectively. A month-by-month IMC growth comparison indicates that April led the way with solid 4.2% gains, then slowed to 0.9% in May and 2% in June. In quarter-over-quarter comparisons, intermodal business accelerated 6.7%.

Access www.intermodal.org for more details.