Spot truckload market volume takes a holiday dip

Activity on the DAT network of load boards slowed for Thanksgiving while the national average load-to-truck ratio rose 7.4% during the week ending November 29, 2014, according to DAT Solutions. The number of available van, refrigerated, and flatbed trucks on the spot truckload market fell 25% and the number of loads dropped 20%, typical of a shorter workweek.

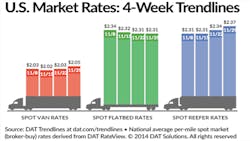

The national average van rate gained two cents to $2.05 per mile (including a 1-cent fuel surcharge increase); pre-Thanksgiving demand and bad weather contributed to the increase in the line-haul portion of the rate. The average rate for flatbed loads was unchanged at $2.31 per mile while the refrigerated rate jumped 3 cents to $2.37.

Regionally, Los Angeles CA-outbound lanes stayed high due to port congestion and difficulty accessing rail services. Average rates from Los Angeles rose 13 cents to $2.60 per mile during the holiday week.

For van freight, the high lane in the region was Los Angeles to Phoenix AZ at $3.30 per mile, up 10 cents compared with the previous week. Other high-paying markets by region:

•Buffalo NY, $2.47 per mile (up 30 cents)

•Memphis TN, $2.44 per mile (up 15 cents)

•Chicago IL, $2.49 per mile (up 15 cents)

Nationally, van freight availability declined by 10% when a 20% drop is typical of a four-day week. Truckload capacity for vans sunk 26%, yielding a 21% increase in the national average load-to-truck ratio for vans, from 3.6 to 4.4. That means there were 4.4 van loads posted for every van available on DAT load boards the week ending November 29.

Reefer freight availability decreased 24% while capacity fell 17%. The resulting load-to-truck ratio was 11.6, down 7.9%. Again, California was a hot outbound market. The average reefer rate outbound from Los Angeles climbed 20 cents to $3.09 per mile. The high lane in the region was Ontario to Phoenix, $4.42 per mile, up 35 cents.

Flatbed load availability receded 28% versus the previous week after a 5.3% gain. Truckload capacity fell 31% so the load-to-truck ratio advanced to 16.8 loads per truck as a national average.

Load-to-truck ratios represent the number of loads posted for every truck available on DAT load boards. The load-to-truck ratio is a sensitive, real-time indicator of the balance between spot market demand and capacity. Changes in the ratio often signal impending changes in rates.

The national average fuel price decreased 3 cents to $3.60 per gallon. Declining fuel prices tend to have a dampening effect on market rates. When fuel prices slip, the surcharge drops and the total rate may fall accordingly.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. RateView’s database consists of more than $24 billion in freight bills in more than 65,000 lanes.

For complete national and regional reports on spot rates and demand, access www.dat.com/Trendlines.