Spot market freight volume recedes 8.8% in August 2015

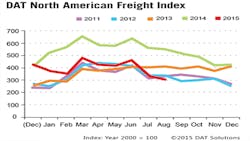

Following a common seasonal pattern, spot market freight volume declined 8.8% month-over-month in August 2015, according to the DAT North American Freight Index. The index fell from July to August in four of the past 10 years. This year’s autumn freight season, which sometimes begins in mid-August, appears to be starting a few weeks later, DAT Solutions reported.

By equipment type, van freight levels dropped 3.7% month-over-month, refrigerated freight edged down 0.4%, and flatbeds were off 18%, for an overall decrease of 8.8% compared with July. Early indications suggest improving van and reefer freight availability in September.

Compared with the extraordinary volume of 2014, August freight was down 44%. Volume for August also fell below same-month totals for the past four years, but freight availability remained strong versus the previous five-year period, from 2005 through 2010, which included a recession.

Comparing freight volume to August 2014 by equipment type, year-over-year, vans retreated 35%, reefers were down 29%, and flatbeds dropped 57%. Line haul rates lost only 1.3% for vans, while reefer rates dipped 1.1% and flatbeds fell 5.8% compared with August 2014, but total rates declined by 11% to 15% due to a 49% drop in the fuel surcharge over the year.

Intermediaries and carriers across North America listed more than 120 million loads and trucks in 2014 on the DAT network of load boards. As a result of this high volume, the DAT Freight Index is representative of the ups and downs in North American spot market freight movement. In 2015, DAT reformulated the index with 2000 as the baseline year.

Access www.dat.com for more information.