January spot market freight volume at seasonal levels

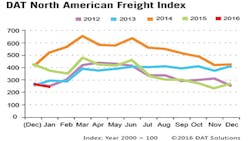

Spot market freight volume declined 9.1% in January 2016 and truckload linehaul rates edged down compared with December 2015. The month-over-month decline was typical of seasonal norms, according to the DAT North American Freight Index.

January freight availability increased in only three of the past 20 years represented in the index. The exceptions were January 2010, 2013, and 2014.

Compared with January 2015, overall spot market freight availability sunk 35%. This continues a 13-month trend of year-over-year declines, due to a combination of tepid freight growth and abundant capacity.

Van demand was down 32%, reefer volume fell 37%, and flatbed freight availability lost 42%, year over year. Linehaul rates fell 7.4% for vans, 7.9% for reefers, and 8.1% for flatbeds, year over year.

Total rates paid to the carrier retreated by 14% versus January 2015, however, due to a 49% plunge in the fuel surcharge, which comprises a portion of the rate.

Since shippers have been cutting back, trucking companies have logged lower profits and several firms have seen their share prices take a dive. However, in an article by the Wall Street Journal’s Loretta Chao and Paul Page commenting on a survey by Cass Information Systems, at least one official representing a major carrier said he was expecting a recovery:

It “feels like there’s still a bit of inventory burn going on,” with retailers holding back on replenishment after overstocking last year, Derek Leathers, president and chief operating officer of Werner Enterprises Inc, said at the BB&T Transportation Services conference this week. But declining gasoline prices eventually will stimulate the retail market, he said.

Freight demand isn’t “robust right now, but certainly it’s not nearly as dismal as some of the commentary,” Mr. Leathers said.

Intermediaries and carriers across North America listed more than 95 million loads and trucks on the DAT Network of load boards in 2015. As a result of this high volume, the DAT Freight Index is representative of the ups and downs in North American spot market freight movement.

Reference rates are the averages, by equipment type, of thousands of actual rate agreements between freight brokers and carriers, as recorded in DAT RateView. Rates are cited for linehaul only, excluding fuel surcharges, except where noted. The monthly DAT North American Freight Index reflects spot market freight availability on the DAT Network of load boards in the United States and Canada.

DAT Solutions LLC is a wholly owned subsidiary of Roper Technologies. See www.dat.com for more information.