Seasonal freight boosts spot market volume during March

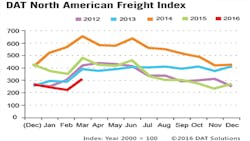

Spot market freight volume got a 38% boost from seasonal freight in March 2016, according to the DAT North American Freight Index. Compared with February, van freight availability in March increased 25%, flatbed volume rose 64%, and reefer volume added 16%. Month over month, linehaul rates on the spot market declined 1.4% for vans, and 1.8% for reefers, but flatbed rates gained 0.6%.

Compared with March 2015, overall spot market freight availability fell 35%. Year-over-year declines have been a consistent pattern in every month since January 2015, due to a variety of economic factors including lower demand for transportation services in the spot market combined with loose truck capacity. Demand dropped 48% for vans and 45% for reefer trailers, while flatbed freight volume was down “only” 16%, year over year. Linehaul rates decreased 16% for vans, 11% for reefers, and 9.6% for flatbeds.

A recent Trucking Conditions Index (TCI) metric by research firm FTR indicated “continued softening” due to a weaker freight environment. However, the company still sees “positive indicators” for trucking and expects its TCI to begin a steady rise into 2017 and 2018. In an April 11 article by Fleet Owner magazine, Jonathan Starks, FTR’s chief operating officer, comments on this prognosis:

“Freight loads are looking to slow this year, but 2% growth is still a reasonable environment for truck operations,” he said. “What it doesn’t do is create pressure on capacity, which is what would be needed to improve the rate environment. A key focus will be whether the manufacturing sector can stabilize and begin to grow again. I believe it will, but it may still be a quarter or two before fleets start to benefit from that activity.”

Starks noted that the freight rate environment has deteriorated, but unless the market sinks further, trucking should expect to see contract rates begin improving in the second half of the year.

“Spot rates have been on a steady decline, but have recently turned back up and should show year-over-year increases sometime this summer,” he pointed out.

Intermediaries and carriers across North America listed more than 95 million loads and trucks on the DAT Network of load boards in 2015. As a result of this high volume, the DAT Freight Index is representative of the ups and downs in North American spot market freight movement.

Reference rates are the averages, by equipment type, of thousands of actual rate agreements between freight brokers and carriers, as recorded in DAT RateView. Rates are cited for linehaul only, excluding fuel surcharges, except where noted. The monthly DAT North American Freight Index reflects spot market freight availability on the DAT Network of load boards in the United States and Canada.

Access www.dat.com for more details.