April spot market freight volume sinks in typical seasonal manner

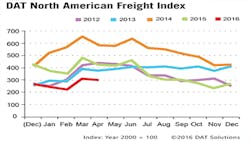

Spot market freight volume edged down 3.4% in April 2016 compared with March, in a typical seasonal pattern, according to the DAT North American Freight Index.

Freight availability in April declined 8.9% for dry vans, volume for refrigerated (reefer) vans slipped 9.4%, and flatbed volume increased 3.9%. Linehaul rates on the spot market fell 1.5% for vans and 0.6% for reefers, but flatbed rates gained 1.2% month over month.

A 41% drop ($0.12) in the fuel surcharge also contributed to the decrease in total carrier revenue per mile. The total rate includes both the linehaul rate and the surcharge, which is pegged to the retail cost of diesel fuel.

Intermediaries and carriers across North America listed more than 99 million loads and trucks on the DAT Network of load boards in 2015. As a result of this high volume, the DAT Freight Index is representative of the ups and downs in North American spot market freight movement.

Reference rates are the averages, by equipment type, of thousands of actual rate agreements between freight brokers and carriers, as recorded in DAT RateView. Rates are cited for linehaul only, excluding fuel surcharges, except where noted. The monthly DAT North American Freight Index reflects spot market freight availability on the DAT Network of load boards in the United States and Canada. Beginning in January 2015, the DAT Index was rebased so that 100 on the index represents the average monthly volume in the year 2000. Additional trends and analysis are available at DAT Trendlines.

Access www.dat.com to learn more.