Reefer freight availability escalates 19% during May

Spot freight availability in May 2016 increased 19% for both refrigerated (reefer) vans and dry vans. Flatbed freight, however, declined by 10% month over month largely due to energy sector woes impacting Houston TX, the top flatbed market in North America.

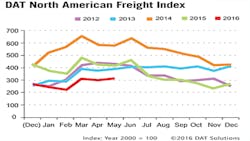

Consequently, overall spot market freight volume rose 5% compared with April, according to the DAT North American Freight Index.

Average linehaul rates on the spot market advanced 1.5% for vans and 4.3% for reefers month over month. During the latter half of May, however, rising rates on the top 80 van lanes far outnumbered declines, indicating rates were following higher demand. Flatbed rates decreased 0.6% month over month.

Year over year, demand dropped 25% for vans, 28% for reefer trailers, and 26% for flatbed freight. Likewise, year-over-year linehaul rates fell 14% for vans, 11% for reefers, and 8% for flatbeds.

Total carrier revenue has been impacted by a 35% plunge ($0.10 per mile) in the fuel surcharge compared with May 2015. The total rate includes both the linehaul rate and the surcharge, which is pegged to the retail cost of diesel fuel.

Established in 1978, DAT operates a network of load boards serving intermediaries and carriers across North America. For more than a decade, it has published its Freight Index, which is representative of the dynamic spot market.

Reference rates are the averages, by equipment type, based on $28 billion of actual transactions between freight brokers and carriers, as recorded in DAT RateView. Rates are cited for linehaul only, except where noted.

Access www.dat.com for further information.