Fewer trucks, more loads push spot truckload freight rates upward

The number of loads on the DAT network of load boards increased 3.2% and load-to-truck ratios moved higher for all three equipment types during the week ending April 7, 2018.

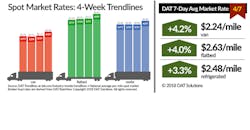

Capacity on DAT load boards fell 2.7%. Fewer available trucks and more loads helped push national average spot truckload rates higher:

•Reefer—$2.48/mile, an 8-cent gain

•Van—$2.24/mile, up 9 cents compared to the March average

•Flatbed—$2.63/mile, up 10 cents to a new record high on DAT Trendlines

Load availability during the first week of April picked up where it left off in March. The number of loads posted in March 2018 was up 92% compared with March 2017, while the number of trucks posted was down 7%.

With 5% fewer trucks posted the week ending April 7, the national load-to-truck ratio for reefers rose 6% to 11.0 loads per truck. Rates were up on 44 of DAT’s highest-volume reefer markets; 25 trended down. California reefer markets continue to strengthen, with the average outbound rate from Los Angeles up 11 cents to $2.90/mile.

The number of available van loads advanced 1% while truck posts declined 2% the week ending April 7, which caused the van load-to-truck ratio to climb 3% to 7.4 loads per truck. Spot rates were higher on 52 of DAT’s Top 100 van lanes. Key van markets:

—Los Angeles, $2.36/mile, up 6 cents

—Houston, $2.21/mile, up 4 cents

—Columbus OH, $2.78/mile, up 8 cents

Flatbed load posts were up 6% and truck posts declined 3% the week ending April 7 and the flatbed load-to-truck ratio gained 9% to 111, the highest-ever weekly load-to-truck ratio in DAT Trendlines for any equipment type. The national average flatbed rate of $2.63/mile is the highest flatbed rate recorded on DAT Trendlines.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends.

For the latest spot market load availability and rate information, visit www.dat.com/trendlines.