Post-Thanksgiving surge pushes spot truckload freight rates higher

Spot truckload freight volumes surged after Thanksgiving, as the number of loads posted on the DAT network of load boards jumped 64% during the week ending December 2, 2017. The number of available trucks gained 22%, DAT reported.

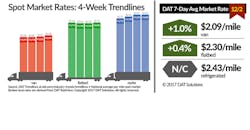

While the large increase in loads and trucks posted is in line with expectations when you compare a long week with a shorter workweek, strong demand for capacity has pushed spot rates unseasonably high:

•Reefer—$2.43/mile, unchanged compared with the previous week

•Van—$2.09/mile, up 2 cents

•Flatbed: $2.30/mile, up 1 cent

Spot van and refrigerated freight rates reached three-year highs in November as a monthly average.

In the reefer market, the number of load posts jumped 55% while truck posts climbed 12% the week ending December 2, propelling the the reefer load-to-truck ratio up 40% to 13.2 loads per truck. Several outbound reefer markets experienced double-digit average rate gains:

•Los Angeles, $2.14/mile, up 25 cents

•Dallas, $2.31/mile, up 10 cents

•Philadelphia, $3.17/mile, up 25 cents

•McAllen TX, $2.23/mile, up 21 cents

Van load post activity surged 68% and truck posts gained 23% as retail goods made their way across the nation from West to East. The van load-to-truck ratio jumped 37% from 6.8 to 9.3 loads per truck and rates moved higher in Midwest and Eastern US markets as shippers position holiday freight near major population centers. The average outbound van rate from Columbus OH added 9 cents to $2.66/mile, Philadelphia was up 4 cents to $2.05/mile, and Dallas rose a penny to $1.89/mile the week ending December 2.

Flatbed load and truck posts advanced, as expected, following the Thanksgiving holiday. The number of load posts gained 67% and truck posts 42%, which caused the load-to-truck ratio to rise 18% to 30.6 loads per truck.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. RateView’s database is comprised of more than $33 billion in freight bills in more than 65,000 lanes. All reported rates include fuel surcharges. For the latest spot market load availability and rate information, visit www.dat.com/industry-trends/trendlines.