Spot market reefer truckload rates spike to highest levels since January

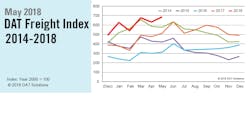

Demand for spot market truckload shipments reached new heights in May 2018, according to the DAT North American Freight Index. Seasonal shipments, along with rising fuel costs, pushed freight rates higher in May, with dry van and refrigerated rates hitting their highest levels since January, and flatbed rates setting a new record.

Spring produce shipments along the southern tier of states contributed to a 9% uptick in spot market volumes, a common trend from April to May. Volumes were 34% higher than in May 2017, according to the index, with much of that increase due to a 69% spike in flatbed volumes year over year.

The peak shipping season out of Florida helped push the average reefer rate to $2.52 per mile, 10 cents higher than the previous month’s average and 50 cents higher than in 2017. Spring harvests contributed to tighter truckload capacity for dry van freight as well, which pushed the average van rate up to $2.16 per mile in May. That rate was 1 cent higher than the April average and a 47 cent gain from May 2017.

“Seasonal demand kept truckload capacity tight across the southern half of the country,” said DAT Solutions industry analyst Mark Montague. “We can expect the high volumes and strong market conditions to keep rates elevated through June and beyond.”

Flatbed demand has been unprecedented in 2018, bolstered by more activity in the energy and construction sectors, and compounded by tighter hours-of-service limitations that have affected every trucking segment since implementation of the electronic logging device (ELD) mandate.

As a result, flatbed rates have set new records. The national average flatbed rate for May was $2.73 per mile, an 8-cent advance over the April average and an all-time high. The national flatbed rate was 63 cents higher than in May 2017, which included a 14-cent increase in the average fuel surcharge from a year ago.

Established in 1978, DAT operates a network of load boards serving intermediaries and carriers across North America. For more than a decade, it has published its Freight Index, which is representative of the dynamic spot market. DAT is a wholly owned subsidiary of Roper Technologies (NYSE:ROP).

Access www.DAT.com for more details.