Spot truckload rates for refrigerated freight dip seasonally

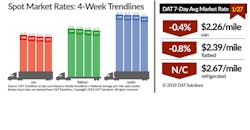

National average spot truckload rates declined for the third straight week but remained higher than at any point in 2017 during the week ending January 27, 2018, said DAT Solutions, which operates the DAT network of load boards.

The rate for refrigerated freight decreased 3 cents to $2.67/mile as produce and other temperature-controlled goods experience a seasonal lull. Van and flatbed rates each fell 1 cent to $2.26/mile and $2.39/mile, respectively.

Spot load-to-truck ratios have eased off from record highs as the number of available loads dropped 3.0% and capacity increased 8.3% compared with the previous week:

•Refrigerated—12.8 loads per truck, falling from 12.8

•Van—8.5 available loads per truck, down from 9.8

•Flatbed—53.9 loads per truck, unchanged

In the reefer market, load posts retreated 14% and truck posts advanced 4%. The national average reefer rate dipped despite strong prices in key markets including Green Bay WI ($4.18/mile, up 18 cents), McAllen TX ($2.95/mile, down 4 cents), Atlanta ($2.89/mile, down 4 cents) and Los Angeles ($3.19/mile, down 13 cents).

Spot van volumes shrunk 5% and truck posts gained 10%. Van rates were down in major markets:

•Chicago, $2.92/mile, down 15 cents

•Columbus OH, $2.78/mile, down 9 cents

•Philadelphia, $2.34/mile, down 10 cents

•Charlotte NC, $2.57/mile, down 5 cents

•Los Angeles, $2.42/mile, down 12 cents

Spot prices for flatbed freight remain seasonally high: the national average flatbed rate slipped 1 cent to $2.39/mile but is buoyed by stronger construction and oilfield activity.

One stat to watch: the national average price of on-highway diesel fuel is $3.03/gallon, and all US regions are experiencing an increase compared with a year ago. Spot truckload freight rates include a fuel surcharge portion.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends.

For the latest spot market load availability and rate information, see www.dat.com/industry-trends/trendlines.