Spot truckload freight rates, volumes hold onto higher ground

Spot truckload freight volume slipped 1.2% and truck posts increased 2% for the week ending March 17, 2018, said DAT Solutions, which operates the DAT network of load boards. Load-to-truck ratios and rates were relatively even, although both are considerably higher compared with a year ago.

The national average load-to-truck ratio for all freight was 14.1, meaning there were 14.1 loads for every available truck, nearly double what it was at this time in 2017. Ratios for all three equipment types were stable week-over-week:

•Reefer ratio—10.1, down from 10.5

•Van ratio—6.8, unchanged

•Flatbed ratio—86.7, down slightly from 88.5

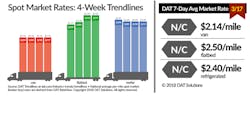

National average spot rates were unchanged versus the previous week but are well ahead of 2017’s pace:

•Reefer—$2.40/mile, unchanged for the third week in a row but 54 cents higher compared with 2017

•Van—$2.14/mile, unchanged for the fourth week in a row but 51 cents higher year-over-year

•Flatbed—$2.50/mile, unchanged but 48 cents higher year-over-year

Refrigerated freight volume rose 9% the week ending March 17, led by gains in 13 of 17 major markets. They include Chicago and Grand Rapids MI in the Midwest (eggs and dairy); Sacramento CA and Twin Falls ID in the West; New Jersey and Philadelphia in the Northeast (imports); and Dallas in the South Central.

California reefer volumes were up 7.6% the week ending March 17, and Florida volumes are gaining strength as fresh fruits and vegetables start to move.

Chicago reefer load availability jumped 16% and rates on several outbound lanes were higher, including Chicago-Philadelphia, up 36 cents to $3.53/mile; and Chicago-Kansas City, up 36 cents to $3.53/mile.

The number of van loads climbed 3.1% and truck posts advanced 2.2% the week ending March 17. Overall, rates trended up on 54 of the Top 100 lanes while 41 were down and five were unchanged.

In the van market, Houston volume jumped 4.6% the week ending March 17. Industrial freight has helped make Houston the leading van market in terms of growth in 2018 so far. Houston-Oklahoma City—a key lane for energy-related freight—surged 22 cents to $2.35/mile.

Capacity in the flatbed market remains tight, as the load-to-truck ratio for flatbeds remains above 80:1.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends.

For the latest spot market load availability and rate information, visit www.dat.com/industry-trends/trendlines.