Reefer, van rates dip as capacity climbs in spot truckload freight market

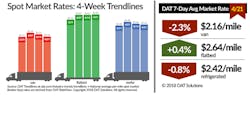

Spot market activity picked up during the week ending April 21, 2018, as the number of posted loads increased 3.1% and truck posts rose 4%. National load-to-truck ratios fell for all three equipment types, which put downward pressure on national average rates for spot refrigerated and van freight:

•Reefer—$2.42/mile, down 2 cents

•Van—$2.16/mile, down 5 cents

•Flatbed—$2.64/mile, up a penny

After a 15% drop the previous week, the national load-to-truck ratio for reefers fell 11% from 9.4 to 8.4 loads per truck the week ending April 21. Reefer load posts slipped 5% while truck posts advanced 6%. As is typical for this time of year, reefer freight is highly affected by regional trends. Lanes to watch:

—Grand Rapids MI–Philadelphia, $3.85/mile, up 44 cents

—Elizabeth NJ–Boston, $4.32/mile, up 13 cents

—Ontario CA–Phoenix, $3.26/mile, up 18 cents

—Atlanta–Lakeland FL, $3.25/mile, unchanged

The van load-to-truck ratio dipped from 6.6 to 6.4 as load posts decreased 1% and truck posts were up 3%. Overall van trends were balanced with rates moving higher on 47 of DAT’s Top 100 van lanes and lower on 48 lanes with five lanes neutral. Key markets:

—Denver: $1.42/mile, up 3 cents. The average Denver outbound rate is up 5.3% over the past four weeks

—Stockton CA: $2.07/mile, up 4 cents

—Atlanta: $2.39/mile, down 3 cents due a stronger Florida market and despite robust outbound volumes

The flatbed market remains solid. Flatbed load posts climbed 7% and truck posts rose 8% as the national average flatbed rate set another record high at $2.64/mile. The load-to-truck ratio fell 1% to 102.2 loads per truck to stay above 100 loads per truck for four weeks in a row.

This report is generated using DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. RateView’s database is comprised of more than $45 billion in freight bills in more than 65,000 lanes.

For the latest spot market load availability and rate information, visit www.dat.com/trendlines.