Reefer, van demand pushes spot rates higher as holidays approach

Demand for vans and refrigerated trucks on the spot truckload freight market was exceptionally strong during the week ending December 1, 2018, said DAT Solutions, which operates the DAT network of load boards.

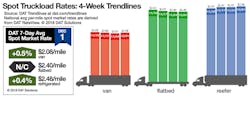

The national average van rate and reefer rate increased 1 cent per mile while the flatbed rate held steady, halting an eight-week decline. Load-to-truck ratios rose for all three equipment types.

As expected, load posts and truck posts advanced significantly in a week that follows a holiday-shortened week. The number load posts was up 54% while truck posts gained 21%. Demand is expected to remain strong through the holidays.

National average spot truckload rates:

•Reefer—$2.47/mile, up 1 cent

•Van—$2.08/mile, up 1 cent

•Flatbed—$2.40/mile, unchanged

Reefer load posts surged 46%, more than expected when going from a holiday week to a non-holiday week, and truck posts climbed 10%. That caused the national load-to-truck ratio to jump from 6.2 to 8.3 loads per truck.

With the holidays coming, meat and potato-growing regions in the Midwest saw big upticks in reefer volumes, and fresh fruit and vegetables boosted load counts out of California.

The biggest reefer rate gains were scattered on lanes across the nation:

•Los Angeles to Denver, up 29 cents to $3.52/mile

•Elizabeth NJ to Boston, up 28 cents to $4.43/mile

•Grand Rapids MI to Philadelphia, up 35 cents to $3.98/mile

•Dallas to Houston, up 19 cents to $3.05/mile

•Twin Falls ID to Baltimore—a long-haul reefer lane—gained 24 cents to $3.26/mile

Van load posts surged 39% and truck posts rose 23% compared with the previous week. The van load-to-truck ratio rose from 6.4 to 7.2.

Rates were higher on 63 of the top 100 van lanes, including several that are strong for retail freight:

•Columbus OH to Buffalo, up 31 cents to $3.99/mile

•Philadelphia to Columbus, up 20 cents to $1.84/mile

•Seattle to Spokane WA, up 31 cents to $3.78/mile

Outbound rates from Los Angeles are 11% higher than they were a month ago, but several lanes declined the week ending December 1, including Los Angeles to Dallas, down 24 cents to $2.41/mile.

Flatbed load posts skyrocketed 103% the week ending December 1 while truck posts advanced 34%. That caused the national load-to-truck ratio to jump from 15.9 to 23.9.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $57 billion in freight payments.

For the latest spot market load availability and rate information, visit www.dat.com/trendlines.