Spot truckload freight rates continue their seasonal slide

Spot truckload rates dipped again during the week ending February 9, 2019, despite higher freight volumes than at this time in each of the past three years, said DAT Solutions, which operates the DAT network of load boards.

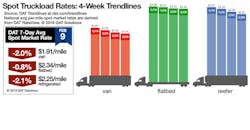

The number of posted loads and trucks both increased 4% the week ending February 9, but rates sagged for all three equipment types:

•Reefer—$2.25/mile, down 4 cents

•Van—$1.91/mile, down 3 cents

•Flatbed—$2.34/mile, down 1 cent

The national reefer load-to-truck ratio moved down from 6.6 to 5.9 reefer loads per truck. Regionally, the focus for reefer haulers is shifting to Florida, where it’s still early for citrus harvests, but prices are firming up on key lanes out of the state:

—Miami to Boston jumped 33 cents to $1.98/mile

—Lakeland FL to Baltimore added 19 cents to $1.83/mile

Higher prices out of Miami and central Florida likely means that strawberries, tomatoes and other mixed vegetables are on the move.

Van load posts on DAT load boards dipped 2% compared with the previous week while truck posts rose 3%. That caused the national average van load-to-truck ratio to decline from 4.8 to 4.6 van loads per truck, although spot van volumes are strong year over year.

Average outbound rates from most major markets are well below where they were a month ago and failed to make gains the week ending February 9. Rates on many lanes affected by extreme winter weather drifted back down to earth, including:

—Chicago to Detroit, down 22 cents to $3.13/mile

—Chicago to Columbus, down 12 to $2.79/mile

—Denver to Albuquerque, down 15 cents to $1.88/mile

The number of flatbed load posts on DAT load boards climbed 16% the week ending February 9 while truck posts were up 9%, an indication that construction season is heating up. It helped lift the national average flatbed load-to-truck ratio from 22.6 to 24.1 flatbed loads per truck.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $60 billion in freight payments. DAT load boards average 1.2 million load posts searched per business day.

For the latest spot market load availability and rate information, visit www.dat.com.