DAT: Truckload van freight volume falls 3%; rates slip lower

Spot truckload freight volume increased 1.2% during the week ending Aug 11, with the availability of spot reefer and flatbed freight making up for a decline in van loads, said DAT Solutions, which operates the industry’s largest network of load boards.

Nationally, the number of available trucks increased 3.7% compared to the previous week. Average spot rates in August remain below July averages.

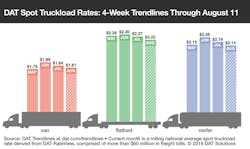

National average spot rates, through Aug 11

- Van: $1.81 per mile, 3 cents lower than the July average

- Flatbed: $2.28 per mile, 5 cents lower than July

- Reefer: $2.14 per mile, 5 cents lower than July

VAN TRENDS

Van volume slipped 3% last week, and 57 of DAT’s top 100 van lanes by volume had lower rates. Among the few positive markets was Buffalo, where van freight volume increased 3% compared to the previous week and the average outbound rate rose 7 cents to $2.08 per mile. Otherwise, spot van volumes have been sliding over the past four weeks, especially in large Southeastern freight hubs:

- Atlanta, down 8% over four weeks

- Charlotte, down 5%

- Memphis, down 7%

- Houston, down 5%

The national average van load-to-truck ratio dropped from 2.2 to 2.1. That’s nearly a full point lower than the August 2018 average.

REEFER TRENDS

Demand for reefer trucks trailed off in California and Texas last week, and the majority of high-traffic reefer lanes paid lower. There were early signs of activity shifting northward, as significantly higher volumes from Denver (up 34%) and Grand Rapids (up 71%) helped elevate the national average reefer load-to-truck ratio from 4.2 to 4.3.

While apple harvests won’t kick-in strongly until the end of August, demand for trucks sent rates higher on key Midwestern lanes:

- Grand Rapids to Cleveland surged 62 cents to $3.71 per mile

- Grand Rapids to Atlanta added 31 cents to $2.59 per mile

- Chicago to Atlanta rose 20 cents to $2.77 per mile

- Chicago to Philadelphia was up 16 cents to $3.03 per mile

- Chicago to Denver increased 13 cents to $2.40 per mile

KEY TAKEAWAYS

- Fewer reefer loads out of California meant truckload capacity was more available elsewhere. Reefer load volume from Los Angeles fell 10% last week, Sacramento was down 5%, and Ontario declined 3%.

- The national average spot van rate is 20% lower year-over-year, when the average rate was $2.31 per mile.

- There’s still uncertainty over how shippers will react to shifting tariff deadlines on Chinese imports. So far in August, spot van volumes indicate a lack of urgency to move goods ahead of the Sept 1 deadline for additional taxes to take effect.

DAT Trendlines is a weekly snapshot of month-to-date national average rates from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $65 billion in annualized freight payments. DAT load boards average 1.2 million load searches per business day.

For the latest spot market loads and rate information, visit dat.com/trendlines.