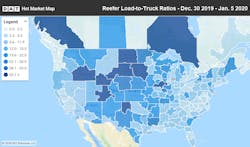

The national average spot reefer rate rose in the first week of January in an unexpected start to the slow season, hitting $2.35 per mile, which is 5 cents better than the December average, according to DAT Solutions, which operates in the industry’s largest network of load boards for truckload freight.

Reefer load counts declined on half of DAT’s top 72 reefer lanes by volume but only three of the top lanes had declining rates. Produce import markets in Florida and Texas, as well as Elizabeth NJ, propelled rates on south-to-north reefer lanes:

- Lakeland FL to Baltimore soared from $1.94 to $2.81 per mile, up 87 cents.

- Miami to Boston increased 48 cents to $2.38.

- Tucson AZ to Los Angeles added 47 cents to $2.65.

- McAllen TX to Elizabeth added 42 cents to $2.93.

“The reason is simple,” said Peggy Dorf, a market analyst with DAT. “Fresh produce makes up a big part of spot market reefer freight, and the winter is not a big produce-growing season in the US. So we import our fresh fruits and veggies from Mexico, via Texas and Arizona, and also from the Caribbean and South America, via Miami.

“Some produce travels by sea all the way up the coast to the port at Elizabeth NJ, but mostly it lands in Florida and heads north by truck.”

Elsewhere, spot truckload freight volumes lagged during the first week of January compared to previous weeks in December but rates continued to show momentum. At $1.97 per mile, the national average spot van rate was 3 cents a mile higher during the week ending Jan 5 than any monthly average rate since 2018.

Freight volumes rose on 50 of the top 100 van lanes compared to the previous week. Van rates gained traction on high-volume lanes originating in six major freight hubs: Dallas, Chicago, Cleveland, Philadelphia, Atlanta, and Stockton CA.

- Dallas to Houston was up 18 cents to $2.47 per mile.

- Chicago to Allentown PA added 12 cents to $2.95.

- Atlanta to Charlotte gained 7 cents to $2.67 per mile.

- Atlanta to Miami rose 14 cents to $2.66.

- Stockton to Ontario CA added 13 cents to $1.76 per mile, and Stockton to Los Angeles got a 7-cent boost to $1.85.

Some lanes with big increases leading up to the Christmas holiday reverted to slow-season form, including lanes with destinations in Memphis, Columbus and Chicago that are associated with retail freight. Columbus to Memphis rates dropped like a rock, from $2.07 to $1.79, a 28-cent loss.

This weekly spot-rate snapshot is derived from DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $68 billion in annualized freight payments.

Visit dat.com/trendlines for more information.