DAT: Spot, contract rates gap narrows in December

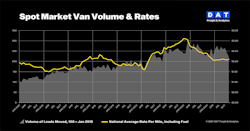

Spot truckload rates rose in December and the gap between spot and contract van rates closed to its narrowest point since March 2022, when prices to move truckload freight were near all-time highs, according to new data from DAT Freight & Analytics.

A convergence of spot and contract rates would signal an end to the current cycle of falling prices for truckload services, DAT reported.

“At 39 cents, the spread between spot and contract van rates is still substantial but was down 7 cents compared to November,” Ken Adamo, DAT chief of analytics, said in a news release. “The price to move van freight under contract hit its lowest point in nearly three years. Entering 2024, shippers are in a strong position as they negotiate contract rates, and carriers on the spot market have some optimism that the market will turn.”

Freight volumes fall for all three equipment types

DAT’s Truckload Volume Index (TVI) fell for all three equipment types compared to November:

- Van TVI: 221, 8.7% lower month over month

- Refrigerated TVI: 182, down 5.7%

- Flatbed TVI: 203, down 14.7%

The van and refrigerated indexes were down nearly 2% year-over-year. “Lower van freight volumes suggest that shippers drew from inventory ahead of the holidays,” Adamo said. “Disappointing freight volumes and less demand for over-the-road truckload services tempered the bump in spot rates.”

Spot rates increase for all three equipment types

Spot line-haul rates, which subtract an amount equal to an average fuel surcharge, increased for all three equipment types compared to November:

- Line-haul van rate: $1.65 per mile, up 7 cents

- Line-haul reefer rate: $1.98, up 4 cents

- Line-haul flatbed rate: $1.87, up 4 cents

Changes to DAT’s broker-to-carrier benchmark spot rates were mixed. The spot van rate averaged $2.10 per mile, up 3 cents compared to November. The reefer and flatbed rate dipped 2 cents to $2.47 and $2.41 a mile, respectively.

The contract van rate fell 4 cents to $2.49 per mile, the lowest since February 2021. The reefer rate was down 6 cents to $2.88 a mile, while the flatbed rate fell 3 cents to $3.14.

Load-to-truck ratios indicate a soft market for carriers

DAT’s national average load-to-truck ratios slumped, driven by the decline in freight volumes:

- Van ratio: 1.9, down from 2.1 in November and from 3.4 in December 2022

- Reefer ratio: 3.4, down from 4.4 in November and from 5.7 year over year

- Flatbed ratio: 5.1, down from 5.9 in November and from 9.8 year over year

Load-to-truck ratios measure the number of loads posted to the DAT One marketplace relative to the number of trucks. Changes in the ratio typically reflect the pricing environment for truckload services on the spot market.