DAT: Reefer truckload volumes rise in July

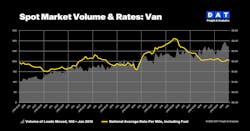

Spot truckload freight volumes in July were stable for the second straight month and up more than 10% year-over-year, a signal that more than two years of deteriorating demand for truckload services may be nearing an end, according to the latest data from DAT Freight & Analytics.

The DAT Truckload Volume Index (TVI), an indicator of loads moved during a given month, increased marginally for refrigerated and van and loads in July:

- Reefer TVI: 205, up 1.5%

- Van TVI: 273, up 0.7% month over month

- Flatbed TVI: 271, down 3.2%

The TVI was higher for all three equipment types compared to July 2023, DAT reported. The reefer TVI was up 13%, the van TVI increased almost 10%, and the flatbed TVI rose 4% year-over-year.

“Near-record container imports and weather-related supply chain disruptions helped drive loads to the spot market at a time when available capacity tightened,” Ken Adamo, DAT chief of analytics, said in a news release. “The pricing environment for carriers showed signs of improvement. National average dry van and reefer spot linehaul rates in July were not year-over-year negative for the first time in 27 months.”

Spot rates hold steady

National average spot truckload reefer and van rates held firm compared to June:

- Spot reefer: $2.45 a mile, unchanged

- Spot van: $2.06 per mile, down 1 cent

- Spot flatbed: $2.60 a mile, down 3 cents

Linehaul rates, which subtract an amount equal to an average fuel surcharge, also were flat. The reefer rate fell 1 cent to $1.98, a penny higher year-over-year. The average van linehaul rate was $1.63 a mile, down 1 cent compared to June and the same as in July 2023; and the flatbed rate declined 5 cents to $1.97, which was 6 cents lower compared to July 2023.

National average rates for contracted freight were generally unmoved:

- Contract reefer rate: $2.81 a mile, unchanged

- Contract van rate: $2.43 per mile, down 1 cent

- Contract flatbed rate: $3.11 a mile, down 3 cents

Load-to-truck ratios decline

National average load-to-truck ratios declined for all three equipment types:

- Reefer ratio: 6.5, down from 7.0

- Van ratio: 4.2, down from 4.7 in June, meaning there were 4.2 loads for every van truck on the DAT One marketplace.

- Flatbed ratio: 11.9, down from 14.6

Ratios were higher compared to July 2023, when the average reefer ratio was 5.4, the van ratio was 3.6, and the flatbed ratio was 9.4.