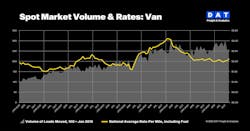

DAT: Spot market demand trends upward

Demand for trucks on the spot market rose in December, suggesting solid retail and grocery sales ahead of the holidays, according to new data from DAT Freight & Analytics.

The van and refrigerated Truckload Volume Index (TVI) increased modestly compared to November:

- Van TVI: 260, up 2.4%

- Refrigerated TVI: 220, up 3%

- Flatbed TVI: 237, down 5%

Year-over-year, the van and reefer TVI were up 12% and 20%, respectively, and the flatbed TVI was 7% higher, DAT reported.

“December freight volumes were strong despite the quirks of the calendar,” Ken Adamo, DAT chief of analytics, said in a news release, while also noting Christmas fell on a Wednesday and there were only three non-holiday weeks between Thanksgiving and the end of the year. “The combination of seasonal volumes, fewer shipping days, and truckers taking time off for the holidays led to higher spot prices compared to November.

“Net fuel, the van rate was the highest monthly average since January 2023.”

Truckload rates shift higher

The national average spot rates increased for all three equipment types:

- Spot van: $2.11 per mile ($1.74 net fuel), up 9 cents compared to November

- Spot reefer: $2.47 ($2.06 net fuel), up 2 cents

- Spot flatbed: $2.39 ($1.94 net fuel), up 2 cents

National average contract van and flatbed rates edged higher last month:

- Contract van rate: $2.42 per mile, up 2 cents

- Contract reefer rate: $2.74 a mile, unchanged

- Contract flatbed rate: $3.06 a mile, up 3 cents

“The difference between van and reefer spot and contract rates narrowed for the fourth straight month and was the smallest since March 2022, when spot rates entered a severe deflationary period,” Adamo concluded. “When the gap between spot and long-term contract rates is trending lower, it’s a signal that capacity is tightening and negotiating power is shifting toward truckload carriers.”