Class 8 orders stabilize in December

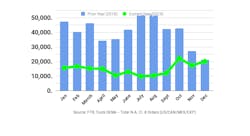

FTR Intel and ACT Research report preliminary North American Class 8 orders reached 20,000 units in December.

FTR said the stable order tally reflects fleets’ caution in the current environment, leading them to only order what they know they need for the next few months. Orders averaged just under 20,000 units a month for the fourth quarter, basically right at replacement demand. Order rates are expected to stay in this range the next few months.

Although the December order activity improved 14% month-over-month, the total stayed below the less-than-robust results seen during October, and was down 7% year-over-year. Class 8 orders for the past 12 months now total 179,000 units, FTR said.

“This is as balanced and stable as you are going to see in Class 8 ordering,” said Don Ake, FTR’s vice president commercial vehicles. “Fleets are ordering trucks according to their standard replacement cycles and also for normal delivery cycles. They are not speculating about the future direction of the freight market because there is too much uncertainty. This is a ‘wait-and-see’ approach.

“The freight market is strong, but growth has stalled. The good fleets are making money, the weak fleets are leaving the industry. It is a rebalancing environment. Fleets have the funds to replace old units and with a growing economy, they have the confidence to do so. However, the equipment market is in a holding pattern due to economic and political factors. The political uncertainty will only intensify up to the election.”

FTR’s final December data will be available later in January as part of its North American Commercial Truck & Trailer Outlook service.

ACT said the 20,000-unit order total is up 14% from November and down only 6.5% from year-ago December as the industry transitions to easier year-over-year comparisons. Complete industry data for December, including final Class 8 order numbers, will be published by ACT in mid-January, the forecaster said.

ACT’s State of the Industry: Classes 5-8 report provides a monthly look at the current production, sales, and general state of the on-road heavy and medium duty commercial vehicle markets in North America.

“Overbuying through 2019 and insufficient freight to absorb the ensuing capacity overhang continued to weigh on the front end of the Class 8 demand cycle in December,” said Kenny Vieth, ACT’s president and senior analyst. “Recalling July and August, orders were down 80% from the corresponding months in 2018. December’s orders brought the full-year 2019 volume to 181,000 units vs 490,100 units in 2018.

“For all of Q4, Class 8 orders were booked at a slightly above the 2019 trend 195,600-unit SAAR.”