ACT Research: Fleets already eyeing 2022 trailer build slots

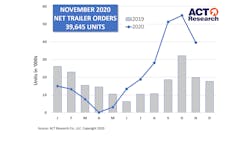

November net US trailer orders of 39,645 units fell nearly 28% from October, but that followed a two-month order surge and still indicates a “solid” month, according to this month’s issue of ACT Research’s State of the Industry: U.S. Trailer Report.

Net orders were up 100% year-over-year and more than 30% year-to-date compared to the first 11 months of 2019.

Before accounting for cancellations, new orders of 41k units were down 28% versus October, but 94% better year-over-year.

“While lower sequentially, November net orders really just took a bit of a breather from the September/October order surge, just missing the all-time top 10 list,” said Frank Maly, director–CV Transportation Analysis and Research at ACT Research. “It is quite possible that the previous two-month surge actually could have generated some minor November headwinds, and not surprisingly, dry vans and reefers are creating the majority of the volume uptick.”

At current production levels, the first available production slots for dry vans and refrigerated trailers, on are in Q4’21, Maly noted.

“But, of course, we’re talking averages. So while some OEMs may be fully committed for 2021 until higher production rates can be generated, some OEMs have remaining 2021 slots,” he said. “This has led us to a surprising industry comment in recent discussions: Fleets were wondering when the 2022 orderboards might open.”

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers and trailer OEMs and suppliers, to better understand the market.