Truck sales hit high note in 2014-- scoring highest level in eight years

Now that the all dust has settled on the order books, it’s very clear that 2014 wound up as a very good year for selling trucks.

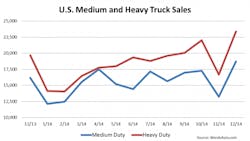

With Decembers result tallied, U.S. Class 8 truck deliveries rolled up 220,405 units in 2014— making for the biggest total since 2006’s record finish, per a news report posted by Paul Zajac, WardsAuto’s manager-- Industry Data. The strong finish was aided by sales of medium- and heavy-duty trucks that climbed 12.9% in December to 42,110 units.

For the year, Class 4-8 OEMs sold 406,747 units. That amounts to a year-over-year increase of 15.6% and the highest total since the 544,581 delivered in 2006, as shown by WardsAuto data.

Meanwhile, ACT Research has cited December as indicative of “healthy” demand for trucks. The research and forecasting firm’s preliminary data shows that 65,700 total North American (N.A.) Class 5-8 orders were booked for the month— which equals a year-over-year figure 41% higher.

ACT also found that “over the past twelve months, N.A. Class 5-8 net orders have totaled 602,300 units– [for] an average of more than 50,000 orders per month.”

Kenny Vieth, ACT’s president & senior analyst remarked that “December’s 43,900 N.A. Class 8 net orders mark the fourth-best month on record and bring the full-year order total to just over 380,000 units.”

December’s preliminary 21,800 N.A. Classes 5-7 net orders equate to the second strongest order-month cycle to date, according to Vieth.

“December’s medium-duty orders rose 44% compared to last December,” he explained. “In 2014, Class 5-7 net orders totaled 222,200 units, up 12% compared to 2013.”

“As has been the case throughout 2014,” Vieth observed, “the strength in order activity is symptomatic of converging trends that are favorable to demand-- including stronger economic activity, lingering pent-up demand, sizeable fuel economy gains and rising carrier profitability."

And research and forecasting firm FTR has advised that its preliminary data indicates N.A. Class 8 truck net orders will come in at 43,620 for December. That would make for the third consecutive month with order activity above 40,000 units.

The firm contended that “December’s order strength, unlike the previous two months, was broad-based among OEMs, with almost all manufacturers showing healthy increases from the previous month,” which would indicate “an overall vibrant truck market.”

FTR put total N.A. Class 8 truck orders for 2014 at 375,000 units, a performance that would mark last year as the second-highest for orders in history (after 2004).

In his detailed report, WardsAuto’s Zajac also related that Class 8 deliveries climbed 14.1% in December on sales of 23,379 units vs. 19,695 a year ago.

As for the medium-duty segments, Zajac reported that:

- Class 7 deliveries rose 19.2% on unit sales of 5,297 vs. 4,272 in December 2013

- Class 6 deliveries gained 14.7% for the month on unit sales of 4,733

- Class 5 deliveries went up 5.6% in December

- Class 4 deliveries increased 5.8% for the month

In addition, WardsAuto found that in December, Class 8 inventory dropped for the first time since June. Yet, year over year, it was still ahead some 8000 units and days’ supply ended at 43-- up from 38the previous December. The medium-duty stood at 45,834 units at the end of the month, making for a 64-day supply.

The complete WardsAuto news article on December truck sales is posted online.

In a separate WardsAuto.com post, Zajac reported that medium- to heavy-duty sales also finished well last year in Canada. North of the border, sales gains were scored for the third month in a row as December deliveries rose 18.8% with all segments reporting year-over-year increases, per WardsAuto data.

WardsAuto found that Canada’s combined medium- and heavy-duty deliveries for full-year 2014 rose 5.2% on volume of 42,496 units vs. the year-ago total of 40,398 units. Class 8 finished the year 5.9% on volume of 29,043 units compared to 27,430 for 2013.