ACT Research: Equipment supply-freight demand imbalance coming

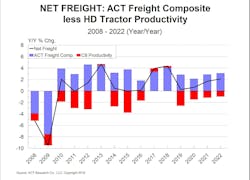

A freight recession is not out of the question, according to ACT Research’s (ACT) latest release of the North American Commercial Vehicle OUTLOOK, but the easier call is a rate recession as truck supply-freight demand fall out of balance.

“While there is a very low probability and no expectation of an economy-wide recession in 2019, freight-related data points have been sufficiently bad in breadth and duration to note that a freight recession is possible,” said Kenny Vieth, ACT’s president and senior analyst.

He elaborated, “That said, slower freight growth, an easing of driver supply constraints, the resumption of the long-run freight productivity trend, and strong Class 8 tractor fleet growth will increasingly pressure contract rates and by extension, trucker profitability in 2019.”

Regarding heavy vehicle demand, Vieth noted, “The rolling-over of ACT’s Dashboard guidance at the end of 2018 suggests today’s order weakness will transition from ‘too much backlog’ to an equipment supply-freight demand imbalance in the near future.”

Despite Vieth’s cautious tenor, he stated that the heavy commercial vehicle market continues to benefit from a still-broad spectrum of supply and demand-side triggers, including a freight rate markdown that is from record highs, desirable new technologies, better fuel economy, and for trailers increased demand for drop-and-hook to keep drivers moving.

Regarding ACT’s medium duty forecasts, Vieth said, “Preliminary March net orders, at 20k, were the lowest on both a nominal and seasonally adjusted basis since July 2018. Below trend demand reduced upward pressure on the forecast that has been in evidence since the first half of 2018.”

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasting services for the North American and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies.

About the Author

Fleet Owner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Cristina Commendatore, Executive Editor

Scott Achelpohl, Managing Editor

Josh Fisher, Senior Editor

Catharine Conway, Digital Editor

Eric Van Egeren, Art Director