How fuel cell and electric trucks could impact regional haul

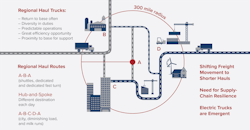

Back in June, the North American Council for Freight Efficiency (NACFE) released the results from the 2019 Run on Less Regional event – a three-week assessment that followed 10 different fleet drivers around the country documenting each vehicle's regional travel. The goal? To determine miles traveled, fuel consumed, pickups and deliveries, elevation change, and vehicle speed among others. The ACT News Aug. 6 webinar, “Keeping It Real: Regional Haul, Zero-Emissions, and Heavy-Duty Tractors,” shared additional insights on what is needed to adopt both battery-electric and hydrogen fuel cell technologies for regional haul applications.

One of the biggest findings reported by FleetOwner in June was that “truck models complemented with the right equipment can increase the regional haul average from 6 mpg to 8.3 mpg,” traveling 435 miles per day on average.

During the webinar, Mike Roeth, executive director of NACFE and regular contributor to FleetOwner, discussed the growth of regional haul.

“Growth in regional haul is good,” Roeth said. “The reason we say it’s good is because it will attract more drivers. Of those 10 drivers, maybe four of those 10 probably wouldn’t be driving a truck if they went all over the country. Secondly, it’s good because of the return-to-base options.”

NACFE’s 2019 Run on Less Regional results noted additional benefits to regional haul include:

- Diversity in duties

- Predictable operations

- Great efficiency opportunity

- Proximity to base for support

NACFE advised the regional haul drivers in the study followed a variety of regional haul routes, including A-B-A which refers to the same out-and-back routes daily; hub-and-spoke referring to a different out-and-back destination daily; and A-B-C-D-A routes which included multiple routes each day.

The 800,000 trucks within the regional haul market, which NACFE defines as Class 7 and 8 tractors that operate within a 300-mile radius of a home base, consume 8 billion gallons of diesel annually with an average fuel consumption rate of 6.0 mpg.

“These 10 trucks averaged the 8.3 mpg. Nine diesel trucks averaged 8.7, one compressed natural gas (CNG) truck did less than that,” said Roeth. “If everybody operated like these 10 trucks, the regional haul market would burn about 5.5 billion gallons of diesel."

“With all of this opportunity with electric and hydrogen fuel cell coming, who knows where we’ll get to and how fast, but a significant amount of that diesel and petroleum-based fuel can go away,” Roeth added.

Battery-electric

Andrew Kotz, commercial vehicle research engineer at the National Renewable Energy Laboratory (NREL) who helped analyze the Run on Less Regional data, provided insight during the ACT webinar on the importance of electrification in the regional haul market.

“I want to reiterate the importance of electrifying these vehicles,” Kotz said. “Regional and long haul make up 1.1% of the U.S. vehicle population, but they account for 17% of the fuel use, so electrifying one of these vehicles can have a huge impact on a per vehicle basis. But first, we need to figure out battery size, charge rate and infrastructure are needed to make that happen.”

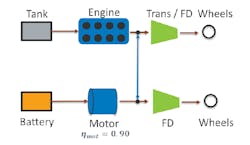

To experiment with this idea, Kotz presented a simple model to demonstrate what it would look like if a gas tank was replaced with a battery.

Assuming 90% of the energy makes it to the wheels, “we were able to test different battery size and charge rate scenarios to see what would allow [a truck] to complete a day of operation that we recorded.”

Using multiple on-road scenarios using A-B-A routes, Kotz determined that bigger batteries are needed to complete recorded trips if charging solely at the truck depot, and that on-route charging can enable a high penetration of electric tractor. However, Kotz confirmed advancements in technology or changes in operation are needed for full electrification.

Hydrogen fuel cells

Alan Mace, market manager at Ballard Power Systems (Ballard), discussed the integration of hydrogen fuel cell technology in the regional haul market.

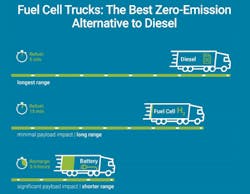

“If you want a full-service, heavy-duty truck that can carry the payloads, manage the routes and long distances without a lot of charging and infrastructure hassles, you really want a [hydrogen[ fuel cell truck,” Mace stated during the ACT webinar.

Mace noted a fuel cell truck can refuel within 15 minutes compared to an electric truck battery’s 3-5-hour recharge time.

“We believe as designs mature and integration on the vehicles improve, that the fuel cell truck will become capable of carrying full payloads over these long-range distances,” Mace added.

According to the Run on Less Regional data, hydrogen fuel cell power requirements of 200-300 kW (270-400 hp) with batteries around 20-30 kWh are needed to meet the duty cycle requirements. Another key difference, according to assessments from Ballard, is the payload capabilities. Fuel cell trucks have a payload capacity of 5,500 lbs less than a traditional diesel truck, while battery electric trucks have a payload capacity of 17,350 lbs less than a diesel truck.

In order to see more widespread adoption of fuel cell technology, Mac suggests the following must be done:

- Regulations requiring zero-emissions

- Cost of technology and fuel

- Deployment should start with fleets

- Initial public support for infrastructure with strategic, thoughtful fuel station roll-out

- Regional clusters with connecting corridors

- Scale – vehicle numbers and fuel production

The start of electric and fuel cell truck integration has already begun with Nikola’s partnership with Anheuser Busch, Daimler and Volvo’s joint venture and Hyundai’s $6.7 billion investment among many others. Ryder recently made Workhorse electric trucks available, Volvo deployed it first pilot electric VNR truck, and BYD has delivered three battery electric buses to Transit Services.

Now, it’s time to make it regional.

About the Author

Catharine Conway

Digital Editor

Catharine Conway is a past FleetOwner digital editor who wrote for the publication from 2018 to 2022.