The 'return-to-base' strategy for charging electric trucks

Fleets using electric vehicles should expect to rely on a “return-to-base” strategy, with chargers located where these trucks begin and end each day, according to a new report from the North American Council on Freight Efficiency (NACFE).

This strategy of owning the charging stations gives companies control over site access, charger type, placement, and timing. It is also needed because charging infrastructure is “one of the largest unknowns and sources of anxiety for fleets considering near-term adoption of this technology,” the report said.

During a conference call, lead author Jesse Lund said fleets with using medium-duty trucks and drayage haulers that can charge near ports are likely to be the first major adopters of electric vehicles.

These fleets need to develop a strong understanding of their existing electric infrastructure, their electricity rates, and the charging needs of their vehicles.

NACFE said fleets should have conversations with utility companies early on, and leave plenty of lead time for approvals and construction. Sites are likely to need a redesign, since hardware must be co-located with the vehicles to allow charging.

Fleets deploying multiple vehicles - or using heavier vehicles with larger batteries - will need to rely on smart charging software to keep costs down, said Lund. Hooking up a large number of electric trucks at the same time could lead to surge pricing.

By having software with the ability to charge various trucks at different points through the night, fleets can avoid variable electricity rates and better ensure the return on investment needed to run electric trucks.

The NAFCE report noted utilities may need to develop new demand management and/or storage solutions to help balance timing concerns with electricity supply and demand. Additionally, new tariff structures may be considered to encourage smart charging.

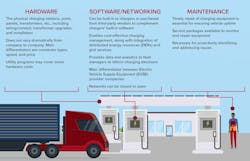

Fleets will also need to choose between different charging stations, depending on how many trucks need to be charged, the size of their batteries, and how long they each have to charge.

The speeds that can charge commercial vehicles are Level 2, which requires installation of charging equipment and a dedicated circuit of 20 to 100 amps, and DC fast charging, which requires installation of charging equipment and a dedicated circuit.

There are also various maintenance packages to consider for a charging network, the report said. All of these needs must be considered on an individual site-by-site basis.

Though wireless charging is also being investigated, it “appears too expensive for the trucking market, with a few exceptions for niche markets,” NACFE said. Other options include overhead or in-ground conductive charging systems, and replacing battery packs more frequently, rather than charging.

Looking ahead, NACFE said any progress on a public charging network should help “relieve some of the ‘range anxiety’ that fleet managers and drivers may feel about potentially running out of power while away from their home base.”

In the end, the group concluded while “not sufficient today, charging infrastructure is not an insurmountable problem.”

Mike Roeth, executive director of NACFE, said this was a “guidance” report, meant to share insights on emerging technologies, in contrast to the group’s frequent “confidence” reports, which look at a more established industry developments.

About the Author

Neil Abt

Neil Abt is a former FleetOwner editor who wrote for the publication from 2017 to 2020. He was editorial director from 2018 to 2020.