There are various ways to track truck safety. There are federal entities that track everything from fatal accidents to recordkeeping compliance. At the state level, both enforcement and regulatory agencies keep their own records of safety-related truck activities. Then there are the databases maintained by insurers, industry groups, safety watchdogs, and even individual fleets.

Given the range of information, looking for insights by comparing different reports and databases is not only frustrating, but it can also often be misleading or easily twisted to promote a specific agenda. There is one common theme, however, running through all the credible truck safety data sources, and it's a troubling one.

Accident rates based on miles traveled began decreasing sharply for all types of vehicles, including large trucks, around 1980. (The Federal Motor Carrier Safety Administration [FMCSA] defines any commercial vehicle over 10,000 lbs. GVW as a “large” one.) Just looking at fatal crashes, the numbers for all vehicles reached an all-time low in 2009, but since then has diverged for cars and trucks. Fatalities for car-only crashes have essentially plateaued over the same time period, drifting slowly lower.

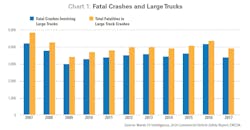

Truck accidents are a different story, with fatality rates rising every year but one, and that one—2014—showed only a small drop. Fatalities from truck accidents have risen from 3,400 in 2009 to just over 4,300 in 2016, the last year with final data available from FMCSA.

While the data is still considered preliminary, 2017 truck fatalities seem to be on the same trajectory (see Chart 1). Although data on accidents involving injury or just property damage is less standardized than federal fatal accident records, both types of accidents have followed a similar trend for trucks.

Every responsible party involved in trucking talks about an absolute commitment to safety, and most believe they are doing everything they can to make it a top priority. Yet the data available tells a different story. How do we account for the disparity between perception and reality?

There's no doubt that assigning cause to the outcomes recorded in truck safety data can be controversial. Both industry supporters and critics use the same data to forward often completely contradictory conclusions, leaving the credibility of those numbers open to question. And given the scope of trucking activities within the broad economy, collecting data with any claim of being comprehensive or even accurate in a generalized sense is impossible.

That leaves speculation. The most common theories point to a combination of extremely tight freight capacity and a shortage of drivers. Capacity issues put a premium on keeping trucks loaded and moving. A shortage of truckers means more inexperienced drivers taking to the road.

It also means pressure to keep current drivers happy by maximizing loaded miles so they can maximize earnings. And the recent move to mandated electronic monitoring of driver hours of service puts pressure on productivity and earnings at just the moment when both are driving trucking activities.

But speculation isn't a good foundation for devising strategies to improve safety performance. It may prove more effective to focus on solutions rather than assigning blame or identifying the reasons for trucking's failing safety record.

While it's still too early to see empirical proof, the application of advanced technologies holds great promise as an effective way to actually improve truck safety. Often called advanced driver assistance systems (ADAS), these technologies are quickly penetrating the automobile market as manufacturers embrace automatic emergency braking, lane keeping assist, and other systems that combine modern sensors with artificial intelligence to control many driving functions.

The physical forces involved with much heavier vehicles pose significant challenges, but ADAS specifically designed for trucks are already on the market, and more active systems are evolving rapidly. We appear to be on the tipping point for widespread availability of ADAS in heavy trucks.

Having advanced safety systems available and broad application of those systems in working trucks are two different things. To find out how many U.S. fleets have already invested in ADAS and what future interest is in making such investments, Fleet Owner has worked with Informa Engage Research to conduct a proprietary survey on fleet experience and interest.

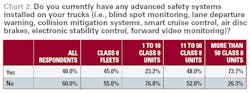

Looking at currently available ADAS, fleets were asked if they are now using one or more of the following: blind spot monitoring, lane departure warning, collision mitigation systems, smart cruise control, air disc brakes, electronic stability control, or forward video monitoring. The overall adoption rate was 40%, which is relatively low given that some ADAS like smart cruise control and electronic stability control have been available for some time at relatively low cost.

However, large fleets—those with 50 or more Class 8 units—had a far higher adoption rate of almost 74%, which may be due to shorter trade cycles or heavier reliance on recruiting and training new drivers whose lack of experience might make such aids more valuable (see Chart 2). The most popular systems are air disc brakes and forward video monitoring, which are being purchased by over 50% of those fleets investing in ADAS. At the largest fleets, video monitoring was the top technology, which is often used as a driver training tool, followed by electronic stability control and collision mitigation braking systems.

Asked about the effectiveness of their technology investments in improving safety, the results bode well for the future of ADAS, with just under 60% indicating they have seen significant or some improvement. For 35%, the jury is still out, and only 6% said they see no improvement.

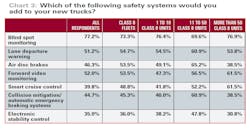

Among the 60% of the fleets that have not yet deployed any ADAS, skepticism of their value is relatively high, with the majority indicating they have no plans to add such systems to new truck purchases. For those that say they will consider ADAS, blind spot monitoring ranks far above all other systems at 77% (see Chart 3).

Asked why they invest or would consider investing in ADAS, the majority said they expect a return on that investment based on lower accident and liability costs. Only 3% say they feel pressure from drivers to add ADAS to their trucks. It remains to be seen whether that pressure grows as younger drivers come into the industry already familiar with ADAS from their cars.

Whether it's a change in generational expectations, more familiarity with the potential of ADAS, or technological developments that lower costs and improve reliability of these types of systems, fleet managers should expect to see a rapidly increasing adoption rate over the next few years.

If nothing else, the industry's safety performance over the last decade needs to be addressed, and this technology holds the most reasonable potential to once again bring those numbers back to a downward trend.

Full results from the survey, as well as detailed analysis of public and proprietary truck safety data, can be found in the 2018 Commercial Vehicle Safety Report from Wards CV Intelligence available at wardsintelligence.com/commercial-vehicle-safety-report.

About the Author

Jim Mele

Jim Mele is a former longtime editor-in-chief of FleetOwner. He joined the magazine in 1986 and served as chief editor from 1999 to 2017.