Key takeaways

- LiDAR prices have fallen from $75,000 in 2015 to as low as $200 today, with further reductions expected by 2028.

- MicroVision plans to introduce a $300 long-range lidar sensor for passenger vehicles by 2028, with potential expansion into commercial trucks afterward.

- Heavy-duty trucks require longer perception ranges, which tends to increase sensor costs. Aeva, Aurora, and Luminar dominate the trucking lidar market today.

As trucks become more technologically advanced by the day, their prices grow. This is especially true as trucks incorporate more sensors to enhance their driver assistance and, eventually, automation.

A key piece of hardware in that sensor revolution has plummeted dramatically in price, however: the lidar system.

In passenger vehicles, long-range lidar system prices have dropped from $75,000 in 2015 to as little as $500 today. And lidar is growing even cheaper still. MicroVision envisions that price to drop as low as $300 by 2028—paired with a smaller and less power-hungry system.

“The differentiator is it’s a smaller package, it’s lower power consumption, and it’s 40% to 50% lower cost,” Glen De Vos, CTO of MicroVision, told a live audience at IAA from the company’s booth.

Why lidar matters for trucking safety, driver assistance, and future automation

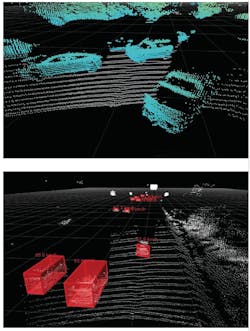

Lidar uses a series of laser reflections to generate a three-dimensional map of its surroundings. For decades, it has been an integral part of autonomous vehicle technology.

Until recently, traditional lidar was large and expensive. A passenger vehicle lidar system in 2015 carried a hefty price tag of $75,000. Technological developments and economies of scale helped shrink sensors’ footprints and bring down their prices.

In China, single long-range lidar unit prices have dropped from roughly $4,100 to only $150 to $200 today, according to executives from China’s Geely Auto Group. Chinese manufacturer Hesai has announced that it would sell its automotive-grade, long-range lidar for under $200 this year.

In the U.S., passenger vehicle lidar prices follow a similar trend. Luminar’s Iris series of long-range sensors, now entering production for Volvo, is estimated to cost roughly $1,000 per sensor. Luminar is also touting a new series of long-range lidar sensors called Halo, which could be 1-inch tall, consume only 10 watts of power, and cost only $500 in 2026.

A significant reason why lidar became so cheap was the transition from mechanical to solid-state sensors. Mechanical sensors from the past required a large, expensive spinning cylinder of mirrors to capture enough laser reflections. Solid-state sensors can emit and capture laser pulses with significantly smaller, less expensive, and less power-hungry hardware. Solid-state sensors are more robust but tend to be limited in their range and field of view.

Long-range passenger vehicle lidar is still more expensive in the U.S. than in China for a few main reasons: The U.S. government has isolated its automotive sector from that of China, reducing manufacturers’ incentives for cost-competitiveness; China’s automotive sector has a greater demand for large-scale lidar production; and sensors in the U.S. tend to require longer ranges for highway speeds.

MicroVision hopes to be the party that implements large-scale production of lidar in the U.S. for manufacturing, defense, and automotive sectors. The economy of scale, De Vos said, could help it achieve that $300 long-range price by 2028.

MicroVision’s Tri-Lidar system: Breaking down perception

MicroVision proposes a trio of short-range and long-range lidar sensors to split up the work of perception, which the company calls Tri-Lidar.

“It breaks the perception task into more manageable elements. You don’t have one sensor doing it all,” De Vos said. The approach helps simplify long-range sensors. “You can narrow the field of view; you can get it to focus on that long-range region of interest much more effectively than if you’re asking it to do everything.”

MicroVision’s Tri-Lidar system would use two of its solid-state short-range sensors (Movia S) and one of its mechanical long-range sensors (Mavin).

Tri-Lidar helps lead to a “smaller package, lower power, and a much better rich point cloud from the system, as opposed to having one single sensor do it all,” De Vos said. “It can easily package in the vehicle—not on the roof, but rather behind the windscreen or in the grill, which is where sensors really want to be at the end of the day.”

The short-range system’s effective range is roughly 30 to 50 meters, depending on field of view, and the long-range system’s effective range is roughly 220 meters.

“Those are ranges which are, we think, in the sweet spot for automotive applications,” De Vos said.

Lower costs

The company plans for a $300 long-range passenger vehicle sensor by 2028, with further cost reductions down the line.

“These are charted to be $200 or less in the corners, $300 for long range,” De Vos said. “That’s this next generation. Our road brings that [cost] further down.”

MicroVision has no passenger vehicle OEM customers to reach that economy of scale today. De Vos said the company expects OEM business within a year and a half.

Adapting lidar for Class 8 trucks: Longer range and higher safety demands

The company hopes to develop its lidar solutions for commercial vehicles as well, though the timeline is less clear. A truck hauling 80,000 lb. would need significantly greater perception range than a passenger vehicle to operate safely.

“The short-range sensor, which we would envision more near-field around the vehicle, or even around the trailer, is exactly the same as what we would plan for auto," De Vos said. "For the long-range, it’s a little bit of a different answer, as requirements typically tend to be a little longer in terms of range. Instead of 220 [meters], you may be at 250 or even 300 and, with that, power levels would change.”

The company would need to redesign its long-range lidar solutions for the field, which may make the tech more expensive.

MicroVision is planning its first wave of products for passenger vehicles in 2028. If all goes well, it could begin producing sensors for commercial vehicles 18 months later.

“If we had a commercial vehicle person come to me today and say, ‘Hey I need it by 2028,’ we could always re-prioritize, but that’s our baseline plan as of right now," he said. "Given the timelines of automation for commercial vehicles, we don’t think we’ll miss the market for that.”

However, once MicroVision decides to step into the field, it faces a similar problem to its passenger vehicle sensors: no OEM customers. The company would face fierce competition from the dominant players in trucking autonomy and ADAS.

Competing lidar suppliers in heavy-duty trucking: Aeva, Aurora, and Luminar

Aeva and Aurora are the current heavyweights in Class 8 truck lidar.

Aeva has partnerships with Daimler Truck for its autonomous Freightliner Cascadia and Western Star trucks, as well as Bendix Commercial Vehicle Systems. Its promised range is significant (up to 500 meters), but its price is unclear today. A few years after its founding in 2019, Aeva promised its sensors would cost under $500. Freightliner has the greatest Class 8 market share in the nation, making Aeva a dominant player in heavy-duty lidar.

Among the industry’s other major OEMs, both Paccar (producing Peterbilt and Kenworth) and Volvo Trucks partnered with Aurora for its autonomous driver, which uses Aurora’s proprietary FirstLidar Lidar system. FirstLidar has a range of over 450 meters but, again, has an undetermined price tag.

Luminar, one of the leading companies for smaller and cheaper sensors, is almost a trucking lidar heavyweight. The company celebrated promising deals with Plus in 2023 as well as Daimler Truck and Torc in 2020. International just began pilots using the Luminar lidar in Plus’s autonomous kit. But the company’s luck is looking worse today. Aeva snatched Daimler Truck in early 2024, and Luminar has seen several major layoffs and executive churn this year.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.