Autonomous trucks are not only coming, they are inevitable. That was a key narrative at the Federal Motor Carrier Safety Administration’s 20th annual Analysis, Research, and Technology Forum held on March 10. Many truck-focused technology startups are currently piloting varied levels of autonomous driving solutions with fleet and OEM partners, though truly driverless trucks, those achieving Level 5 automation, may be many years away.

“Nothing will happen overnight, but automated vehicles will certainly make inroads into that [longhaul driver] workforce,” stated FMCSA Acting Administrator Meera Joshi.

“But this is a reality and there will be a major shift in the workforce,” Joshi said.

To find out how much of a shift self-driving trucks create, she advocated for more education and conversations with stakeholders, a common practice when the FMCSA is forming new regulations.

That is a major indicator that the Department of Transportation is readying for changing landscape where certain trucks’ hours of service will be the same as truck stops: 24/7.

Because of this, and the other industries automation looks to disrupt, such as retail and manufacturing, the new administrator stressed that “the extremely real and broad impacts of automation on people’s livelihoods” are a “priority” for the Biden administration and departments of Labor and Transportation.

Automation has long been a perceived threat to blue-collar jobs. Its first form was as the chassis-lifting robots in automotive plants in the 1960s and ‘70s, and over the past decade, has sneaked onto truck sensors and computers to swipe the seats of professional drivers. It’s a fear as old as the industrial revolution.

Such an uproar is unlikely in the trucking sector, as autonomous technologies are already routinely deployed to make the roads safer for everyone. Advanced driver-assistance systems (ADAS), including lane-departure warnings and collision mitigation, have proven their worth for several years.

J.B. Hunt, for example, found rear-end crashes dropped 50% since 2011 when the fleet’s trucks were first outfitted with forward-collision warning systems.

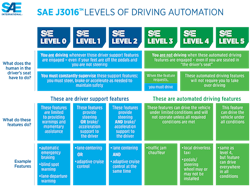

That is basic Level 1 automation, while technology such as Detroit Assurance 5.0 and Bendix Wingman Fusion, which feature lane-keeping assist and automatic braking, are Level 2.

Here's the full SAE International breakdown:

It’s the Level 4 and 5 tiers that could incite fears of job loss.

Joshi empathized with the looming trepidation that may be felt among many of the roughly 2 million heavy-duty truckers operating in the U.S.: “If it’s your livelihood that seems like it’s being threatened, it is an immediate problem.”

She then mused that self-driving tech developers want the evolution of self-driving tech to accelerate.

Because it is inevitable, it’s time to start thinking about how to find new livelihoods for these soon-to-be-replaced workers, such as truckers. Joshi did wonder what is to be done with the long haulers.

“What are the opportunities, thinking about the now, for the shifting workforce? What are the training opportunities so the next generation has [automation-proof] jobs,” Joshi questioned.

Facts over fear

While the overall message of autonomous vehicles’ ascension was true, it may be misperceived by the public, cautioned Finch Fulton, the former deputy assistant secretary for transportation policy at the DOT under the Trump administration.

“The acting administrator wasn't wrong in what she said, but the headlines are getting it wrong and the narrative is wrong,” Fulton told FleetOwner. “That’s because if you tell people that it ‘seems’ their jobs are being threatened, they're going to think it is.”

But that’s not what he thinks is going to happen at all.

“If you are a trucker today, you are unlikely to lose your job due to automation,” Fulton said.

As the DOT’s ear to the ground on all things futuristic – including drones, hyperloop systems, machine learning, and commercial space, Fulton’s office was intimately familiar with autonomous vehicle (AV) policy, which he agrees is " probably the closest [of these technologies] to being a routine common reality"

The research he has seen “shows they'll probably be ready to do this routinely closer to the end of the decade, then the next few years,” Fulton said. “Others are saying two years away, but they've been two years away for the last few years.”

Even if Level 4 AVs arrived tomorrow, the rate of adoption would be slow and have an incredibly long lag time.

He cited a recent DOT study called " Macroeconomic Impacts of Automated Driving Systems in Long-Haul Trucking," that when factoring for a medium adoption rate, found “only 48% of trucking firms would be able to buy the technology in the decade after it becomes available.” At the slow end, it’s 19%.

If these trucks did become available by 2031, it could be well past 2040 before it impacted even half of the fleets.

“That's a lot of lifetime,” Fulton said. “That's 20 years. A 48-year old truck driver has been worried about maybe being impacted.”

Forty-eight is the average age of truckers, Fulton pointed out, while 61% of new truck drivers are older than 40 and 33% are older than 50. And 10% of truckers retire every year, he added.

That recent report also noted, “lower employment levels for long-haul truck drivers can largely be offset with natural occupational turnover.”

What if self-driving trucks do come faster than expected?

“Lay-offs for long-haul truck drivers are anticipated in the fast adoption scenario,” the report concluded, though “those lay-offs occur only during a period of five years and the maximum lay-offs in a single year is 11,000, just 1.7% of the long-haul driver workforce.”

There will be net gains for the total U.S. workforce, with employment increasing “by 26,400 to 35,100 jobs per year on average during the analysis period, despite decreases in employment for long-haul truck drivers.”

Some of those jobs created would be managing and operating AVs, jobs to which truckers could transition, Fulton noted.

The productivity benefits of a more autonomous transportation industry would “raise annual earnings for all U.S. workers by $203 per worker per year under the slow scenario and $267 per worker per year under the fast scenario."

Fulton’s office also reviewed a 2021 joint department report to Congress on autonomous long-haul trucks and transit buses commissioned as “a comprehensive analysis of the impact [of] ADAS and HAV technologies on drivers and operators of commercial motor vehicles, including labor displacement.”

The report, which the current DOT would be using to help steer policy, found: “The timeline for development of Level 4 or 5 capabilities is highly uncertain, but widespread adoption is not generally predicted to be imminent.”

It theorizes that long-haul truckers, particularly in the for-hire segment, would be most impacted by Level 4 or higher automation, and this could cover 300,000 to 500,000 long-haul truckers.

Of these, subtract drivers who haul hazardous materials, oversized loads, or transborder crossings, as the Congressional report acknowledged these are “resistant” to automation due to non-driving tasks.

Fulton said a shortage of drivers, which The American Trucking Associations estimates is over 60,000 truckers now and 160,000 by 2028, will also cover any shortfalls created by self-driving trucks. And these numbers don’t include increases in last mile and e-commerce, trends that began because of the COVID-19 pandemic and look to increase over the next decade.

Human-centric AVs

Fulton, who recently was hired by Locomation, a Pittsburgh-based autonomous truck startup as vice president of policy and strategy, believes “human-centric autonomous trucking models may win out.”

That, of course, may have to do with Locomation providing such a solution. The company plans to retrofit Class 8 trucks with the Autonomous Relay Convoy (ARC) system, a two-truck solution where both have sensors, interfaces, artificial intelligence, and automated steering and braking. The front driver is behind the seat of a truck using Level 2 automation, while the back driver can be in the back, either in the sleeping berth or at the table doing paperwork, because the truck is following the other truck’s lead.

The back truck gets up to a 10% fuel efficiency from the drafting, and that driver would not accrue hours of service. And the pair switches roles when the other driver is ready for a long break.

This circumvents not only HOS restrictions, but also reduces the need for truck parking, which can be difficult to find.

That is just Stage 1 for Locomation, founded in 2018 by experts at Carnegie Mellon’s National Robotics Engineering Center, the cradle of self-driving innovation, and other trucking industry veterans. There are three others.

Stage 2 would involve one manually piloted truck with a driverless truck following. This driver would handle road inspections and issues that may occur with either truck.

Fulton said this is expected to increase a fleet’s utilization rate and double the driver’s miles generated, and thus their earning potential. This could actually entice more drivers to the industry, Fulton said. Shippers also benefit by getting twice as many goods and materials through one driver.

Level 3 would involve a hub-to-hub model, where purely driverless trucks could perform certain routes, such as between distribution centers. And Stage 4 would be reached when Level 4 autonomy has matured. When this happens, tose drivers would ideally move to managerial roles at the depot or warehouse overseeing the AVs.

Before either of those can happen, the AI needs to learn from the road data collected from the convoy model, and fleets can glean in which applications AVs make the most sense, Fulton explained.

When fully commercialized, the company said per convoy, the solution would reduce operating cost per mile by 30%, which includes an 8% drop in fuel consumption. This would also eliminate 40 metric tons of CO2 from the air.

Wilson Logistics placed an order for the ARC system last September. Locomation will supply at least 1,120 Wilson trucks with the technology. This will start in 2022 and the deal is through 2028.

“In Locomation we see the most viable path to safe, rapid, and broad commercialization and we’re proud to make this purchase commitment,” said Darrel Wilson, founder and CEO of Wilson Logistics “Locomation delivers both the technology and the implementation methods required to enable Wilson Logistics to realize our strategic plans for profitable growth through technology.”

The fleet tested the ARC system last summer on a 420-mile route from Portland, Ore., to Nampa, Idaho.

Fulton compared this human-centric model to when the aviation industry deployed autopilot. He noted commercial planes used to require three pilots but now need two.

“Pilots were concerned that they would be run out of a job by autopilot,” he said. “And there's still a shortage of pilots.”

This is due to a ready supply and “skyrocketing demand,” Fulton said. The global civil aviation industry may need 264,000 new pilots over the next decade, according to Canadian training provider CAE.

“Automation did not drive pilots out of a job, and so that's kind of what we're expecting with automated trucks as well,” Fulton concluded.

About the Author

John Hitch

Editor

John Hitch is the editor-in-chief of Fleet Maintenance, providing maintenance management and technicians with the the latest information on the tools and strategies to keep their fleets' commercial vehicles moving. He is based out of Cleveland, Ohio, and was previously senior editor for FleetOwner. He previously wrote about manufacturing and advanced technology for IndustryWeek and New Equipment Digest.