The concept is called “Uber for trucking”—at least that’s what many in the public call it. For trucking fleets and shippers, however, it’s not quite that simple. From load matching to real-time tracking and exception management, a combination of technologies are offering freight shippers advancements never seen previously.

“The undeniable reality is that every company in the world is trying to drive more speed and efficiency in the supply chain,” said Ajay Agarwal, managing director at Bain Capital Ventures.

“In my nearly 30 years, I’ve never seen such a high focus on performance as I see right now,” said Jeff Tucker, president and CEO of Tucker Company Worldwide.

Load matching is just “the tip of the spear,” Tucker said in an interview with Fleet Owner. “We have rung tremendous waste from the system,” and are able to change the behavior of fleets and suppliers through data analytics.

“Carriers, brokers, shippers, receivers, equipment manufacturers, et. al., must get on the technology bandwagon now or avoid being left behind,” John Larkin, managing director of research for Stifel Financial Corp., wrote after attending a Northwestern University Transportation Center Business Advisory Council meeting.

Existing technology, combined with the growing area of artificial intelligence, “can dramatically improve our internal processes and operational efficiencies,” Doug Waggoner, chairman and CEO of Echo Global Logistics, said during its latest earnings conference call.

Echo is among the logistics firms and freight brokers pouring millions of dollars into upgrading its technology. XPO Logistics, J.B. Hunt Transport Services, and C.H. Robinson are a few of the others that have followed suit.

Owner-operators are also benefiting through easier access to technology, giving them less motivation to seek work from large carriers, Tucker explained. He noted there has been a 93% bump in the number of for-hire carriers with between one and six trucks over the past four years. Many of these same owner-operators are among the most vocal opponents of the electronic logging device (ELD) mandate.

For others, ELDs are viewed as a key piece to unlocking technology’s full potential. The ELD mandate, Agarwal said, means many small fleets will be equipped with GPS technology for the first time—“a huge leap forward.”

Tucker said ELDs will foster more accurate pickup and delivery windows, and load matching that factors in available hours and fueling needs. Within a decade, “we will know with a good degree of confidence a sequence of loads,” he surmised.

Several ELD makers including BigRoad have already started adding freight-matching algorithms to their service offerings. Others like ERoad are linking up with tech firms like FourKites, which specializes in real-time tracking and supply chain visibility across multiple transportation modes and digital platforms, said CEO Matt Elenjickal.

FourKites, which has received an investment from Bain Capital, created an ELD certification program to help carriers fulfill mandatory shipment visibility requirements and improve on-time performance. Among FourKites’ largest customers are Smithfield Foods, Cargill, and Kraft Heinz.

As part of the recent FourKites deal with Kraft Heinz, FourKites is providing real-time tracking in addition to temperature monitoring. And with the advanced analytics capabilities of FourKites, Kraft Heinz will be able to identify trends on wait times and other metrics.

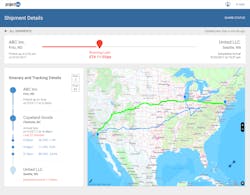

Another company focused on integrating with proprietary and third-party telematics systems and ELD vendors is project44. Jett McCandless, president and CEO, said project44’s technology provides shippers shipment visibility and exception management through application programming interfaces (APIs). The company has shied away from developing its own app.

APIs allows for better “information asymmetry” than electronic data interchange (EDI) systems, or more old-fashioned methods of the telephone and fax machine.

Evans Transportation Services Inc. is one logistics provider to recently announce it was integrating project44’s technology to automate the end-to-end management of less-than-truckload shipments. David Cochrane, vice president of information technology at Evans, cited the need for “meticulous data transparency” in selecting project44 as a partner.

During the fall of last year, project44 launched a new solution for truckload visibility that eliminates “visibility gaps” within dry van, reefer, flatbed, heavy haul, and drayage hauls. Project44 is connected with more 90,000 trucking companies, and it offers features such as exact latitude and longitude locations, delivery times, and geofencing.

The emergence and wider acceptance of technology has led to the acquisition of—or investment in—digital freight matching firms by other technology companies or logistics firms. One example is DB Schenker’s $25 million investment in uShip, announced in February 2017.

Mike Williams, CEO of uShip, said his company is about providing small businesses “tools they never had access to before.” Previously, they “had to pick up the phone call to call a broker and trust it was a good deal. They didn’t have a lot of options.”

Founded in 2004, Austin, TX-based uShip opened a new headquarters building last year for its 225 employees. The company started in the consumer segment, connecting a network of carriers to deliver large, bulky items such as furniture. UShip also allows shippers to put pallets of freight up for bid.

More recently, uShip has moved into what Williams called the “enterprise” space, connecting logistics firms such as DB Schenker and shippers to an online marketplace providing different services to a wide range of trucking sectors.

Looking ahead, McCandless of project44 sees an almost unlimited growth for digitalization and technology. He said the industry is only 1% of the way toward where he believes the technology capabilities need to be.

“There are so many obstacles and barriers to overcome,” McCandless said. “That is what makes it so exciting.”

About the Author

Neil Abt

Neil Abt is a former FleetOwner editor who wrote for the publication from 2017 to 2020. He was editorial director from 2018 to 2020.