Top 10 FleetOwner operations and safety stories of 2023

This was another challenging year for trucking, and FleetOwner reported on the stories necessary to keep fleets safe and profitable. There were economic concerns to plow through alongside often-high diesel prices to pay. Drivers looked to stay safe, and carriers looked to protect themselves from ever-rising cargo theft risks.

The past year, readers sought information on changes among trucking's major players, whether it be a large carrier acquiring another or a fleet having to close shop. Smaller carriers faced struggles, and capacity and rates fluctuated.

10. Fleet costs jump 21.3%, with fuel by far the leading expense

Fleet operational costs rose 21.3% in 2022 over the previous year, says a leading trucking industry research group, and the culprit last year was an all-too-familiar one: fuel, the cost of which rose almost 54% over 2021. But a lot more besides pricey diesel and gasoline contributed to drive expenses to new highs in 2022, according to the update to an annual American Transportation Research Institute report.

The message of the ATRI update, "An Analysis of Operational Costs of Trucking," is a clear one: Between the historically high cost of fuel, pressures to improve pay (especially among drivers), surging insurance premiums, and other expenses, plus losses from equipment maintenance, turnover, and excess detention time, fleets are being squeezed like never before, with many of them exiting the industry altogether. Read more...

9. CVSA's 2023 changes to OOS criteria are in effect

Nine changes made to the Commercial Vehicle Safety Alliance’s (CVSA) North American Standard Out-of-Service (OOS) Criteria for 2023 are now in effect. OOS criteria are updated annually and become effective April 1 each year.

Here are the changes for 2023: Read more...

8. As cargo theft continues to rise, experts advise on prevention and spotting fraud

Shippers and carriers should be vigilant as new data shows 2022 saw an increase in cargo theft from the year prior, and experts indicated it's a trend that shows no signs of slowing.

Theft prevention and recovery network CargoNet has reported that almost 1,800 theft claims were made by its members last year—an increase of 15% from 2021, which saw fewer than 1,300 incidents reported. Read more...

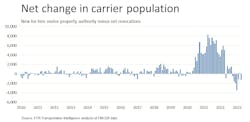

7. Trucking ‘clearly starting to lose capacity’

Trucking—because of a variety of factors such as a record exodus of fleets and a bottoming spot market—is bleeding capacity, one industry analyst said.

But the slowdown in the freight economy has been like a river in a drought where its level is going down. Other trends of late in related sectors such as ocean shipping, ports and container movements, and intermodal also are starting to become apparent, according to FTR Transportation Intelligence analysts, who spoke during a recent webinar on the state of U.S. freight. Read more...

6. As rates still lag, trucking forecast is cloudy going into 2024

Prevailing sentiment earlier this year said that trucking was headed toward a recession like the rest of the U.S. economy. Though opinion has shifted against even a mild downturn nationwide as interest rates have come under control, freight-hauling itself still has challenges heading into 2024 with flat rates, deflated capacity, demand that still is stubbornly down, and suddenly reinflated fuel prices, as several new reports show and industry analysts say.

Two trucking data aggregators, ACT Research and FTR Transportation Intelligence, led the way with recent outlooks that are decidedly mixed, with FTR's slightly more pessimistic. A red flag for FTR and a third industry data firm, DAT Freight & Analytics, remains a slumping spot market with rates on DAT's load board, DAT One, trending as much as 11% lower than in 2022. Data from another load board that FTR watches and partners with on reports, Truckstop, yields similarly shabby results. Read more...

5. Exodus of fleets reaches historic levels in Q1, U.S. data shows

The tumbling freight spot market and historically high fuel prices are teaming up to push more small fleets out of the trucking industry—which is setting records in carrier departures this year, according to the latest federal data—amid the backdrop of a fits-and-start economy on the edge of recession.

This means many trucking companies—31,278 of them in the four months to start the year, this data shows—are folding up shop and leaving the industry. Or their operators are leasing their services to larger fleets. And more are filling seats as company drivers, easing the driver shortage. Read more...

4. FMCSA proposes long-awaited changes to CSA, eliminates IRT

The Federal Motor Carrier Safety Administration (FMCSA) has proposed some significant, highly anticipated changes to the system it uses to identify motor carriers that pose the greatest safety risks.

In proposed changes to its Safety Measurement System (SMS), the agency declined to adopt a more convoluted item response theory (IRT) model as an alternative to the existing SMS methodology. Proposed revisions to SMS, which uses data from roadside inspections, crash reports, and investigations to identify and prioritize carriers for intervention, include: Read more...

3. Knight-Swift to buy U.S. Xpress in $800M+ deal

The leaders of Knight-Swift Transportation Holdings have signed a deal to acquire U.S. Xpress Enterprises, which would unite the Nos. 3 and 20 fleets, respectively, on the FleetOwner 500: Top For-Hire list.

The proposed transaction, which is expected to close around mid-year, has an enterprise value of $808 million. U.S. Xpress investors would receive $6.15 per share in cash, which is more than four times the price at which the Chattanooga-based company’s shares closed on March 20. U.S. Xpress has struggled in recent quarters with a combination of leverage, high insurance claims, and lagging volumes. Last fall, the carrier launched a restructuring plan aimed at cutting $25 million in costs per year. Read more...

2. Yellow’s exit ‘reshuffling’ the LTL deck

In the wake of the third-largest U.S. less-than-truckload carrier folding its operations, the LTL market has undergone a radical capacity shift. “We are seeing a reshuffling of the deck of freight,” an LTL expert told FleetOwner after Yellow Corp., which was No. 6 on the 2023 for-hire FleetOwner 500, filed for bankruptcy.

“Carriers are using the Yellow collapse as an opportunity to not only take advantage of the supply-side shock to lift rates but to optimize the freight they’re moving,” Kevin Day, president of LTL at AFS Logistics, explained. “They have this influx of volume looking for a home, and they’re evaluating it against their existing volumes. If there’s something from former Yellow customers that fits their network better, they’re looking to purge over-length, lightweight, and less desirable freight.” Read more...

1. Cooling demand, recession concerns kick off 2023, though trucking can expect gains

High fuel and equipment prices, labor concerns, shipping rates, inflation, talks of a recession, and other economic factors have followed trucking into what is a historically quiet season for imports and consumer demand at the start of a new year. Because of these lingering headwinds, for the first quarter, carriers are likely concerned about a decrease in rates due to an oversupply of capacity built up from 2021.

The market, however, is cyclical, and trucking remains the most relied-upon freight transport mode in the U.S., with trucks moving some 12.5 billion tons of freight valued at more than $13.1 trillion, according to the newly released Bureau of Transportation Statistics 2022 Transportation Statistics Annual Report. Read more...

About the Author

FleetOwner Staff

Our Editorial Team

Kevin Jones, Editorial Director, Commercial Vehicle Group

Josh Fisher, Editor-in-Chief

Jade Brasher, Senior Editor

Jeremy Wolfe, Editor

Jenna Hume, Digital Editor

Eric Van Egeren, Art Director