Earlier this month, FTR reported that the trucking economy was making a V-shaped recovery as the effects of the COVID-19 pandemic begin to soften. Cass Transportation confirms that analysis with its own report, Cass Transportation Index Report September 2020, that provides month-by-month updates on the transportation industry.

The report is broken down into four parts: Cass Freight Index – Shipments, Cass Freight Index – Expenditures, Truckload Linehaul Index, and Intermodal Price Index.

According to the report, the Cass Freight Index shows the V-shape of recovery. “Earlier in the year, as the economy was starting to reopen, there was a lot of speculation surrounding the 'shape' it would take – everything from an 'L' to a 'V' to a “W” to a Nike swoosh to a square root sign,” the report said. “[The market] should see positive y/y comps for the first time all year in October, if the absolute level just holds at September levels.”

Shipments

Related specifically to how much freight is moving, Cass Freight Index shipment volumes were only 1.8% below year-ago levels, as seen in the chart below, significantly better than last month’s (7.6%) y/y change, and the best comp reported since November 2019.

The raw index number rose 7% from August’s level to the highest reading, also since November 2019, according to the report.

"The shipment index is now 27.5% higher than the April lows, and we see it staying strong through year-end, as inventories remain relatively lean, and we expect freight to keep moving," said the report.

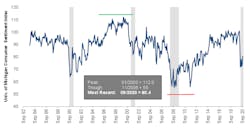

Consumer confidence, while still low, is seeing signs of life, which, according to the report, may be due to optimism around the election, from businesses continuing to re-open, and/or healthcare advances, which should be good for future Index numbers.

The report also states that air cargo remains tight, and there will be high rates through year-end due to:

- Most commercial belly capacity staying out of the market until probably mid-to-late next year

- An increase in consumer electronics product launches in Q4 2020, such as the iPhone 12

Expenditures

With respect to overall spend on transportation, the Cass Freight Index for expenditures – which measures the total amount spent on freight – increased 1.2% y/y in September, – 7% higher than last month, 29% better than May’s low, and the highest freight spend since June 2019 – and that’s with significantly less contribution this year from fuel surcharge revenue, the report stated.

The report shows that cost per shipment is increasing as trucking rates rise with "real constraints on driver and industry supply and fewer trucks running, so as freight has rebounded, the capacity squeeze has driven rates up significantly." Cass Transportation doesn’t expect much capacity entering or returning the rest of the year, so as supply/demand remains tight, the company expects continued growth in the average freight bill.

Truckload Linehaul Index

The Truckload Linehaul Index (TL), measuring per-mile linehaul rates, looks at the largest market in the domestic transportation landscape. This Index declined 3.4% y/y in September. Still, this was the highest reading since December 2019, indicating a turn in truckload pricing. Cass Transportation believes it is not higher only because it’s mostly tied to contract rates and not the faster-moving spot market. As contract rates are "repriced over the coming quarters, this will play catch-up and turn to y/y growth," the report stated.

According to the report, the combination of rising and healthy demand with limited supply is causing shippers to pay more to get their freight moved, as “turn-downs” by carriers are still at very high levels. Cass Transportation explains that this is evident from the spot rates posted in through early October as spot rates are tracking much higher y/y – including fuel surcharges – in the dry van, flatbed, and reefer markets, with dry van now above 2018 peak levels.

Cass Intermodal Price Index

The Cass Intermodal Price Index, measuring total per-mile costs, looks at the smaller intermodal market and shows much worse trends than TL, falling to a new low of 21.4% y/y in September and down 4% sequentially from August – not due to fuel. According to Cass Transportation, this is the lowest absolute reading since September 2010. There are two main drivers of this are:

- The fuel surcharge – while the Cass Truckload Linehaul Index excludes fuel surcharge, the intermodal index includes fuel surcharges

- Intermodal pricing has been on a lag vs TL pricing, so as intermodal demand improves further, and TL contract rates move higher, intermodal rate increases should follow

After a big step up in September, in both shipping volumes and overall spending, Cass Freight expects the rising price environment to continue through year-end and into 2021, as contract pricing in both TL and intermodal are reset higher. The report predicts demand should be strong at least into Q1 2021 due to inventory restocking, foreshadowing a positive y/y shipment growth in Q4 of this year.