Midyear Class 8 orders stabilize, allowing OEMs to focus on backlogs

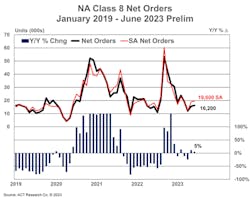

North American Class 8 truck orders remained stable in June, ranging from 13,800 to 16,200 units, according to projections from the two leading research firms that track the commercial vehicle market. Analysts expect that the slower order pace, coupled with high build activity this summer, should allow OEMs to cut into the backlogs they’ve had going back to 2022.

Preliminary data from ACT Research pegged the June figures at 16,200 heavy-duty vehicle orders, a 5% increase from ACT’s June 2022 figures and a 4% increase from May orders.

FTR Transportation Intelligence, like last month, reported a smaller order number for June that was still greater than the firm expected going into the final month of the second quarter. The nearly 13,800 Class 8 unit orders tracked by FTR in June are about even with its May report and down 7% compared to June 2023. These figures from FTR, which put total Class 8 orders over the past 12 months at 297,800 units, puts North American fleet order activity below replacement demand.

“FTR has been anticipating net Class 8 orders to drop over the last several months to below 10,000 units,” Eric Starks, FTR chairman, said. “This has not occurred, which is a positive sign that fleets still need equipment. However, with all the order slots filled for 2023 and 2024 slots yet to be fully opened, it is unclear when these ordered trucks will be built.”

See also: Class 8 sales trend up, costs to run them keep rising

Starks noted that OEMs have hinted for months they could keep build activity elevated through the end of the year. “With the recent solid order totals, it is all but guaranteed that Q4 production will be strong,” he said. “OEM build slots for 2024 are not expected to open until August at the earliest.”

The robust Class 8 orders in the final months of 2022 combined with more normal seasonal order patterns in early 2023 were expected to moderate into the middle of the year, according to Eric Crawford, ACT VP and senior analyst. “June orders were in line with this view, bringing the year-to-date monthly seasonally adjusted average to 18,200,” he explained. “The relatively few build slots still free in the second half of ’23 suggest order intake is unlikely to find meaningful traction until 2024 order boards open.”

OEM backlogs will keep shrinking thanks to the seasonal midyear slowdown and strong build activity, FTR’s Starks added. “This will pull backlogs back into a normal range over the next several months as the backlog-to-build ratio is currently elevated and putting pressure on OEMs to keep building equipment,” he said.

Medium-duty orders

See also: Mack MD Electric available to order

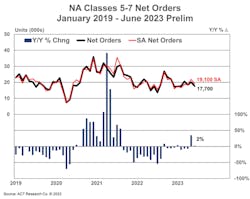

A modest increase in demand for medium-duty units was reported by ACT, which also tracks Class 5 through Class 7 vehicle orders. Crawford said orders increased 2% year-over-year to 17,700 medium-duty vehicles. That total is down 12% from May’s figures.

“The seasonally adjusted June intake, at 19,100 units, increased 2% year-over-year, equivalent to about 229,000 units on an annualized basis,” Crawford added.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.