While low spot rates reveal a silver lining, truck build cuts appear imminent

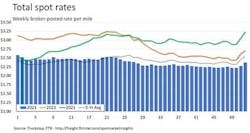

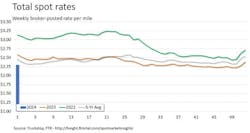

Ahead of the hustle and bustle of the gifting and gathering season, in week 51 of 2023, spot rates climbed to their highest week-over-week increase since mid-May and were at their highest level since August, according to FTR, a transportation forecasting firm, and Truckstop. Total spot rates hovered slightly above $2.25 per mile but did even better in the final week of the year.

Week 52 of 2023 saw a surge, fueled mostly by “one of the largest increases in refrigerated spot rates ever,” FTR stated on its website. The total rate increase of nearly 10 cents was the largest increase since the holiday season of 2022.Although the year ended on a higher note, as expected, spot rates declined in the first week following the seasonal holiday surge. FTR and Truckstop data revealed a spot rate decline of 7.4 cents. But surprisingly, the rate decrease was the smallest for the first week of the year since 2018.

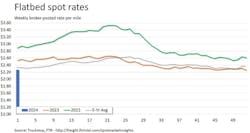

Dry van spot rates declined barely more than a penny, and flatbed spot rates rose slightly in the first week of the year when they typically see a rate decline in week one. Load volume also saw a sharp increase.

See also: FTR: SCI showed significant improvement in October

Total load activity

Although total load volume was down nearly 28% compared to week one of 2023, total load activity in the first week of 2024 rose 51.7%. Truck postings increased by 7%, and the ratio of trucks to loads rose to its highest level since May.

Spot rates

With the lowest decrease in spot rates since the first week of 2018—which FTR pointed out was soon after the ELD mandate took effect—rates were still nearly 11% below the same week a year ago.

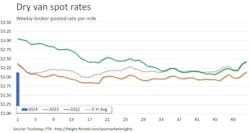

Dry van spot rates

Dry van spot rates saw a small decline of just over 1 cent for the first week of the year, with rates more than 10% below the same week last year and roughly 9% below the five-year average. However, dry van loads jumped 42.6% after falling nearly 24% in the previous holiday week. Load volume was 38% below the first week of 2023 and roughly 40% lower than the five-year average for week one.

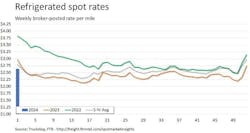

Refrigerated spot rates

The spot rate that surged during the last week of 2023 with a 40-cent increase then fell by 10 cents in the first week of 2024. Refrigerated spot rates were about 11% lower compared to this time last year and around 6% lower than the five-year average. Load volume in this segment rose by only 3.5% but was still nearly 36% below the volume in the same week of 2023 and about 38% lower than the five-year average.

See also: Reefer remake: Arctic Express a picture of success worth seeing again

Flatbed spot rates

Flatbed spot rates saw roughly a 1-cent increase week-over-week after falling almost 6 cents the week before. This is nearly 11% below week one of 2023 and about 3% lower than the five-year average for the week. Load volume in this segment picked up a whopping 105.5% after a 39% decrease in the prior week. Even with the increase, however, volume was still about 16% below last year’s numbers and about 43% lower than the five-year average for the first week of the year.

What's ahead for truck builds in 2024?

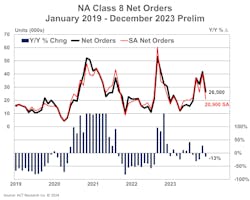

ACT Research, another economic forecaster for the transportation sector, recently released its predictions for Class 8 truck builds for 2024: imminent build cuts.

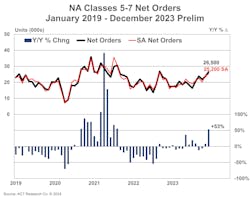

Classes 5-7 order numbers were identical to Class 8 orders at 26,500 units in December, which was up from November order numbers by 4.6%. Vieth said December was the best month of the year for medium-duty truck orders “on both a nominal and seasonally adjusted basis.” In total, medium-duty truck orders for 2023 were 245,700 units, Vieth said.

See also: Class 8 orders slow in December but market still at a ‘high level historically’

What’s ahead with Class 8 orders for 2024? With strong truck build rates and slowing tractor sales, 2024 Q1 could see a surge in Class 8 inventory—and there have already been accumulations of that inventory growth seen within the past two months, according to ACT.

“Something we marveled at, as late as this September, was the close correlation between build and sales that had kept Class 8 inventory levels, both nominal and relative, near perfectly positioned very late into the cycle,” Vieth said. “Increasingly, with inventories already rising and the sales calendar becoming unfriendly in early 2024, the data suggest this cycle will not provide an ‘it’s different this time outcome,’ with more inventory accrued in the last two months than the preceding twelve months.”

Vieth concluded by saying that the Class 8 forecast has anticipated a slowdown in production for 2024 Q1, and because significant inventory stockpiling isn’t expected until January and February, “we are probably early in our call for build rate cuts sooner.”

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.