October trailer demand improved but still well below average

Key takeaways

- FTR found that October trailer orders totaled 15,916, down 5% YoY but up 77% MoM.

- This October's trailer orders are less than half the month's 10-year average of 37,116.

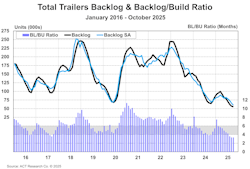

- Backlog-build ratios are at decade lows, due to continued OEM production despite low demand.

- Analysts largely blame trade policy and continued weak fleet sentiment.