Trailer orders surge to two-year high, but market headwinds push volatility into 2026

Key takeaways

- Trailer orders surge: Preliminary U.S. trailer net orders rebounded to a two-year high in December 2025.

- Dry van demand: The year-end rebound was primarily driven by dry van orders, indicating that deferred fleet equipment plans were finally being converted into new demand.

- Production low: Despite the order surge, U.S. trailer production in December fell to its lowest levels since September 2010.

- Tariff headwinds: The market remains constrained by policy-driven cost inflation and trade uncertainty from tariffs, shaping 2026 pricing and demand.

- 2026 outlook: Analysts from both FTR and ACT Research caution that a sustained demand recovery has not yet been confirmed, and the market is opening 2026 with only "cautious optimism."

Preliminary U.S. trailer orders rebounded to end 2025 at levels not seen in two years but still fell below the 10-year December average, according to two commercial vehicle research firms that track fleet equipment trends. This mirrors the significant jump in Class 8 vehicle orders in December.

According to FTR Transportation Intelligence: December net orders jumped to 24,282 units, an 86% increase compared to November’s figures.

According to ACT Research: December orders rose 112% compared to the 11,900 orders the firm tracked in November. The 25,300 orders booked in December were nearly 5% higher than in December 2024.

Yes, but December orders lag 10-year average: FTR analysts noted that despite the substantial sequential increases, December’s orders were down 4% year over year and well below FTR’s 10-year December trailer order average of 33,623 units.

ACT Research noted that the seasonal adjustment for trailer orders lowers the monthly total to 18,600 units. Both research firms typically finalize their order data by the end of the month.

What they’re saying: “Sequentially, a slight uptick in net orders was expected, as December is usually the second strongest order month of the annual cycle,” Jennifer McNealy, director of CV market research and publications at ACT Research, said this week. “That said, preliminary data showed new vehicle demand for power units jolt awake in December, and those same factors of a firmer economic foundation, December’s weather-induced spike in freight rates, increasingly aged fleets, and some level of tariff-related clarity are also in play for trailing equipment demand.”

Dry vans drive month-over-month rebound: The order board's rebound to close out 2025 was led primarily by dry van orders, according to FTR analysts.

Key factors driving December trailer order surge: FTR cited various factors for the surge in December. These included fleets deferring equipment orders throughout the fall, attempts to get ahead of potential tariff-related cost passthroughs, and an antidumping and countervailing-duty investigation into van trailer imports from Canada, Mexico, and China.

Improved visibility for fleet capital-equipment planning following November clarity around Class 8 tariffs and EPA 2027 NOx regulations, as well as early signs of stabilization in spot freight markets, also likely contributed, according to FTR analysis.

2026 commercial vehicle market recovery outlook: Despite these positive signs to close out 2025, which also saw Class 8 vehicle orders reach a three-year high, FTR analysts say it’s too early to “declare that a sustained demand recovery has begun.” The firm cautioned that a more durable, growth-oriented equipment ordering rebound likely won’t emerge until freight fundamentals and fleet profitability show meaningful improvement.

Cautious optimism opens the new year: ACT Research noted last week that 2026 begins with signs of cautious optimism for tractor and vocational markets, with some trailer demand growing later in the year.

“Firstly, the economy, aided by AI tailwinds, continues to outperform expectations, with GDP rising 4.3% in Q3,” Ken Vieth, ACT’s president and senior analyst, noted. “Crucially for the trucking industry, consumer spending remains robust, accounting for more than half of Q3 GDP growth. Though concerns about the balance of growth persist, as wealthy households are behind most of the spending.”

Vieth also noted that freight spot rates surged through November and December, driven by consumer spending, severe weather, and further capacity contractions.

Fleets are also gaining more clarity on the looming Environmental Protection Agency (EPA) 2027 regulations, which are expected to remain firm on powertrain technology to reduce NOx, but reduce mandates for manufacturers to provide expensive extended warranties and useful-life provisions.

“In addition to regulatory pressures aiding demand, increasingly older fleets should facilitate some additional replacement demand in 2026,” Vieth said of the Class 8 power unit market.

But ACT sees trailers facing a different demand in 2026. “End-of-2025 challenges continue as the trailer industry enters the new year, and opportunities in early 2026 remain thin,” McNealy said in ACT’s State of the Industry: U.S. Trailers report on January 21. “Positively, freight rates are now rising, and the need to replace aging equipment continues to build. Pent-up replacements are expected to improve demand later this year.”

2025 trailer orders vs. 2024 performance: December’s preliminary trailer order tally brings Q4 net orders to 53,400 units, according to ACT. This closes out 2025 with 172,100 trailing equipment orders—about 6% more than the orders ACT tracked in 2024.

FTR tracked a similar 2025 order total (173,144 units), up 5%, reflecting demand deferred ahead of the 2024 presidential elections until early 2025. Despite the December surge, FTR notes that Q4 2025 orders still lagged Q4 2024 by 20%.

Near-term headwinds include uncertainty and inflation: “The U.S. trailer market is increasingly constrained by policy-driven cost inflation and trade uncertainty, which are now the primary forces shaping pricing and demand,” Dan Moyer, FTR commercial vehicle senior analyst, said this week. “Section 232 tariffs on steel, aluminum, and downstream products, including heavy-duty cargo trailers and key components, have established a durable higher-cost base with little prospect of near-term relief. The potential for higher van trailer costs due to the antidumping investigation also might already be influencing sourcing and pricing decisions.

According to ACT’s McNealy: “While a better year than 2024, concerns about the level of economic activity that drives transportation demand: still-weak, although improving, for-hire carrier profitability; and uncertainty about future government policies remain as challenges to stronger trailer demand in the near term.”

U.S. trailer production falls to 15-year low: With low backlogs and weak demand defining much of 2025, U.S. trailer production in December fell to its lowest levels since September 2010, according to FTR.

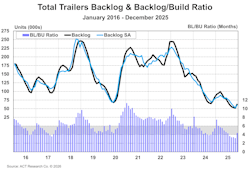

Total builds declined 13% month over month and 6% year over year to 11,801 units, FTR noted, as OEMs continued to curb output. December also marked the first time since March 2025 that orders exceeded production, lifting month-over-month backlogs 16% to 84,501 units.

However, backlogs are down 21% year over year, highlighting a subdued order environment. The backlog/build ratio improved to 7.2 months, offering modest near-term production visibility, according to FTR. The firm cautioned that this improvement’s sustainability depends on order trends into early 2026.

ACT Research saw bigger backlogs and lower December build rates to close out the year, pushing the ”backlog-to-build ratio higher for the first time in 2025,” McNealy said. “Backlogs started the year at 7.5 months and trended lower from there. December’s 4.4-month ratio commits the industry into Q2‘26.”

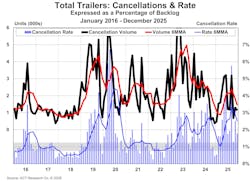

High cancellation rate persists: ACT Research noted that December’s trailer cancellation rate, as a percentage of the backlog, was a relatively high 1.8%—but down from November’s 2.5%. “Data continued to show elevated cancellations in the van and tank segments,” McNealy said in ACT’s trailer report. “The highest cancellation rates came from the tank segments, attributed to a decline in oil/gas activity.”

Fleets likely to remain cautious about purchases: “Overall, entrenched tariffs and unresolved trade actions are likely to keep demand cautious and costs elevated, reinforcing selective purchasing and a stronger focus on total cost of ownership,” FTR’s Moyer added.

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.