Spot TL rates, volumes dip

The abundance of truckload freight on the spot market poured over into the week ending Aug. 19.

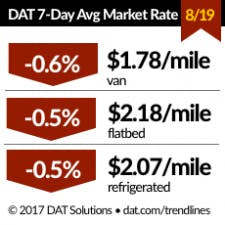

The number of posted loads fell 2.1% compared to the previous week while available capacity was unchanged, said DAT Solutions, which operates the DAT network of load boards. National average van, flatbed, and refrigerated rates all declined slightly but, like freight volumes, remain strong overall.

Nationally, van load posts fell 1% and truck posts increased 1% to push the van load-to-truck ratio from 4.9 to 4.8. The national average van rate fell 1 cent to $1.78/mile, a small change in an otherwise firm freight market.

Refrigerated load posts increased 6.5% last week while truck posts slipped 0.5% amid shifts in seasonal freight patterns. The Midwest is heating up for reefers, which is a normal trend for this time of year. More loads are moving out of the Grand Rapids market, and outbound rates rose in Green Bay and Chicago. More loads left Sacramento last week but it’s still not a high-volume market at this point in the summer.