Diesel slides slightly, nearing EIA's 2023 benchmark price

The average U.S. diesel price fell slightly the week of Jan. 17—2.5 cents to $4.524 per gallon—getting closer to the $4.48 benchmark the U.S. Energy Information Administration (EIA) forecast for 2023.

Translation: There’s room for the average to fall more, to better the EIA prediction, and to approach and perhaps reach pre-Ukraine invasion levels.

The one-year anniversary of the Russian incursion is approaching. The diesel average the week before the invasion was $4.055. The fuel had been rising before the attack, but it really took off March 7, the week after the invasion of Ukraine began: 74.5 cents to $4.849, the largest one-week increase in the history of EIA reporting.

Diesel now sits at almost 80 cents above a year ago due to the price increases that followed that geopolitical and energy market-shocking event.

See also: Carriers continue to fold as pandemic freight boom recedes

But diesel prices are in recovery. Trucking’s main fuel also is down for the week of Jan. 17 in every region and subregion of the country, save for the Gulf Coast, where the average ticked up a tenth of a penny, and the Rocky Mountain region, where it rose 3.2 cents to $4.729 a gallon.

Motor club AAA had diesel dropping week-over-week even more than EIA, 5.6 cents to $4.597 per gallon, though AAA has the nationwide average slightly higher than the U.S. government energy reporting agency does.

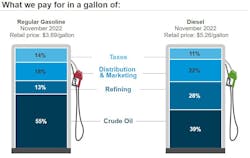

Gasoline, also pumped by some commercial fleets and widely used by consumers, had been falling faster than diesel, but the U.S. average for gas the week of Jan. 17 rose about a nickel to $3.310 per gallon, but still was $1.214 less than a gallon of diesel. Gas now is a fraction of a penny more than it cost a year ago, and it rose in most regions and subregions of the U.S. that EIA measures.

Uncertainty about oil prices, a traditional barometer

Based also on current crude oil prices, analysis by FTR Transportation Intelligence suggests that diesel fuel prices are 40 cents to 50 cents higher “than we normally would see,” Avery Vise, FTR’s VP of trucking, said during the industry data analyzer’s State of Freight webinar on Jan. 12. “So, there is still some potential there, arguably, for diesel prices to come down further.”

“Oil price trajectory this year remains uncertain and depends on economic outcomes in major economies,” said Madhavi Bokil, SVP at Moody's Investor Services. “We expect two opposing market forces will keep oil prices highly volatile this year: a slowdown in demand and restricted supply.”

See also: Spot market returning to ‘seasonal’ and ‘normal’ after 2021 surge, 2022 slump

According to Oil & Gas Journal, Brent crude oil prices declined to about $80 per barrel as of Jan. 3 from over $120 in June 2022, a 33% decline in just six months, despite global supply constraints and lingering uncertainty about Russian producers' ability to maintain export volumes amid sanctions instituted after its invasion of neighboring Ukraine.

“These factors outweighed market concerns about supply constraints and declining global inventory levels. As estimates for 2023 oil demand moderated, so did the risks of spiking prices from the December implementation of the U.S. and European oil price cap, and Russia's threat to divert oil and refined product sales away from countries supporting the price cap.”

About the Author

Scott Achelpohl

Managing Editor

Scott Achelpohl is a former FleetOwner managing editor who wrote for the publication from 2021 to 2023. Since 2023, he has served as managing editor of Endeavor Business Media's Smart Industry, a FleetOwner affiliate.